A tweet from content creator Gagan Choudhary has gone viral, reigniting public debate on India’s high import duties. Choudhary shared that he was slapped with a hefty custom duty charge of ₹11,800 for importing camera accessories worth Rs. 25,000 from the United States.

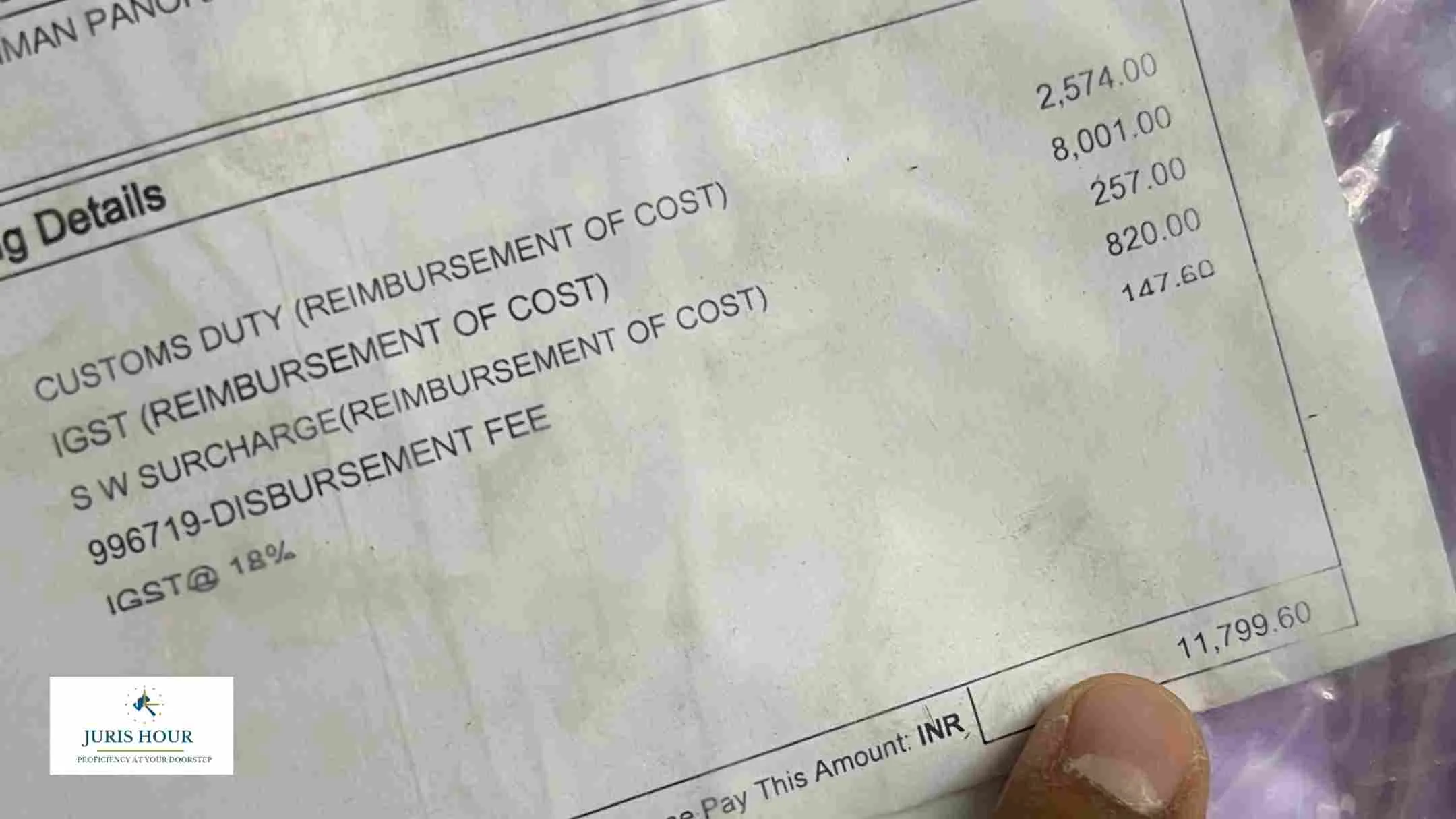

The bill, which he posted on Twitter, breaks down the total charge as follows:

- Customs Duty (Reimbursement of Cost): ₹2,574

- IGST (Integrated Goods and Services Tax): ₹8,001

- Surcharge & Other Fees: ₹1,224

(Including SW Surcharge ₹257, Disbursement Fee ₹820, IGST @ 18% ₹147.60)

“Almost 50% tax main chala gaya. I am paying from income jispe 15–20% already tax dena hai,” he wrote, expressing frustration.

Why the High Charges?

Under Indian law, goods imported for personal use are subject to customs duties and IGST. The IGST is levied at the applicable GST rate (typically 18%) on the value of goods plus shipping and customs duty. This effectively pushes the tax burden significantly higher than anticipated by most consumers.

Choudhary’s case highlights a common pain point for Indian consumers who order specialized goods not available domestically. Despite already paying income taxes, they are faced with additional import levies, often nearing half the product’s original cost.

Public Reactions and Policy Debate

The tweet has sparked a wave of responses from netizens, many sharing similar experiences. The issue touches upon broader discussions around:

- Lack of availability of niche goods in the Indian market.

- Double taxation concerns for end consumers.

- The need for reform or clarity in personal import duties for low-volume, non-commercial purchases.

As India pushes toward becoming a global digital and creator economy, calls are growing louder for a re-evaluation of customs and import tax structures — particularly for professionals relying on international-grade equipment.

Read More: CMA Neeraj Dhananjay Joshi Elected Vice President of ICMAI for 2025–2026