The Air Cargo (Imports) at IGIA, led by Dheeraj Rastogi, receives special mention in Weekly Newsletter issued by Sanjay Kumar Aggarwal, the Chairman of Central Board of Indirect Taxes and Customs (CBIC).

The Special Investigation and Intelligence Branch of Air Cargo Complex (Import), Delhi Air Cargo (Imports) at IGIA, headed by Dheeraj Rastogi, gets a special mention by the Chairman, CBIC, in his latest weekly newsletter has unearthed a significant case of misuse of the Advance Authorization (AA) scheme, resulting in an estimated duty evasion of Rs. 15 crore.

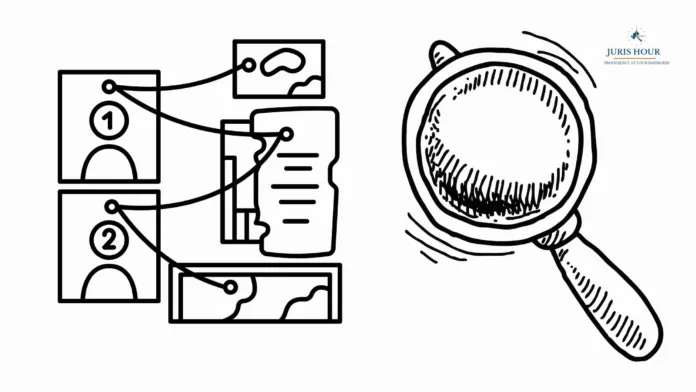

The investigation was triggered by data analysis, which indicated non-fulfillment of export obligations by the importer. Detailed examination of two live consignments revealed that the importer had misdeclared finished goods as raw materials to avail duty-free benefits. Further inquiry exposed the use of forged documents during customs clearance, along with evidence of past fraudulent transactions dating back to 2012.

Searches at nine premises across Bengaluru, New Delhi, and Haryana led to the seizure of incriminating digital and physical records, including parallel invoices. Taking quick action, the Directorate General of Foreign Trade (DGFT) has been apprised to halt the discharge of export obligations linked to the AA.

Sanjay Kumar Aggarwal, the CBIC Chairman remarks it as commendable work!