In what could trigger a major data privacy controversy, allegations have emerged that the Goods and Services Tax (GST) department’s sensitive taxpayer data—including contact numbers, email addresses, and business details—is being accessed by private companies and sold through high-priced subscription plans.

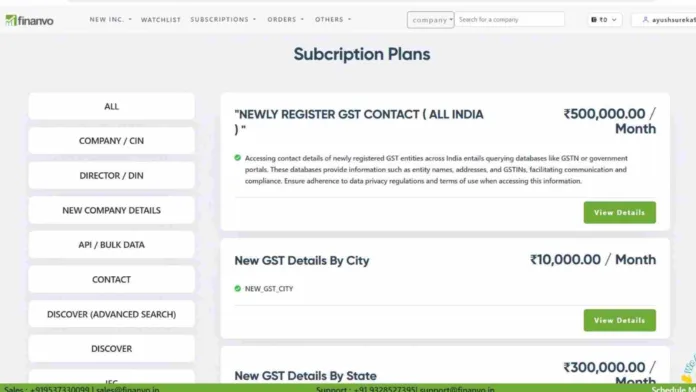

A screenshot circulating on social media shows a platform, Finanvo, offering monthly subscription packages reportedly fetching up to ₹500,000 for access to “newly registered GST contacts across India.”

The subscription plans prominently advertise access to detailed records of entities registered under GST, encompassing names, addresses, GSTINs (GST Identification Numbers), and other personal or business information. According to the claims, this data is extracted by querying official portals like GSTN or government databases, and then packaged for commercial sale to marketing firms and other buyers.

Experts have pointed out that such practices, if proven, could constitute a grave violation of the right to privacy as upheld by the Supreme Court in Justice K.S. Puttaswamy vs Union of India. The unauthorized disclosure and commodification of personal data without taxpayer consent may also run afoul of data protection obligations under the Information Technology Act, 2000 and the pending Digital Personal Data Protection Act.

Digital rights advocates expressed alarm at the apparent scale of monetization. “Selling taxpayers’ private information not only undermines public trust in government systems but also exposes individuals and companies to unsolicited marketing and potential fraud,” said a senior lawyer specializing in data protection law.

The subscription page displayed in the screenshot offers various categories of data access—from “New GST Details By State” priced at ₹300,000 per month to “New GST Details By City” for ₹10,000 per month—suggesting a structured market for these datasets.

Industry observers have called on the GST Network (GSTN), Infosys (which manages key elements of the GST infrastructure), and the GST Council to clarify whether any official permissions or contractual arrangements allow such data scraping and resale. The GSTN has previously maintained that taxpayer data is secure and access is tightly regulated.

Social media posts tagging @Infosys_GSTN and @GST_Council demanded an urgent investigation into how private companies could routinely access and commercialize information from official records.

At the time of publication, there was no official statement from GSTN or Infosys responding to these allegations.

Potential Legal Implications

Legal experts caution that if taxpayer data is indeed being harvested without authorization, the companies involved could face significant penalties and be subject to criminal liability. Additionally, impacted taxpayers may be entitled to remedies including damages and injunctions to prevent further dissemination of their information.

Way Forward

Stakeholders are urging the government to conduct an immediate audit of data access logs and enforce strict compliance with privacy safeguards. Until further clarity emerges, taxpayers are advised to remain vigilant for any suspicious communications that might arise from unauthorized use of their GST-registered contact details.

Read More: Navigating Accident Lawyer Fees and Legal Support in India: What You Should Know