Online food delivery platform Swiggy has introduced a new “Rain Fee” of ₹25, citing the need to support delivery partners during adverse weather conditions. The move, however, has sparked fresh debate among consumers, as the government has also imposed Goods and Services Tax (GST) on this additional charge.

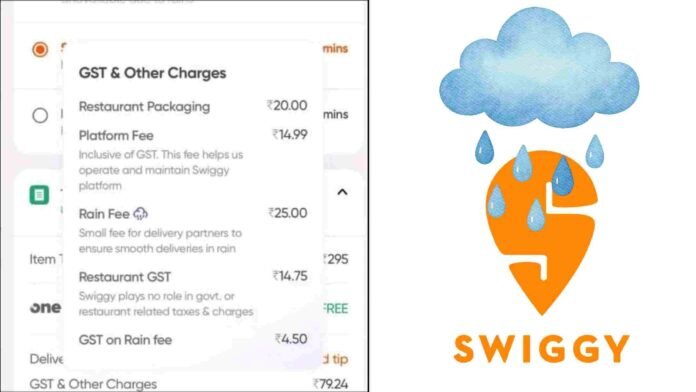

According to Swiggy’s billing breakdown, the rain fee is described as a “small fee for delivery partners to ensure smooth deliveries in rain.” Alongside this, customers are also billed for packaging, platform fee, and restaurant GST. What has caught public attention is the extra ₹4.50 GST levied on the rain fee itself, effectively raising the cost burden on consumers.

Multiple Layers of Charges

A recent Swiggy invoice shows the following breakup of charges:

- Restaurant Packaging: ₹20.00

- Platform Fee: ₹14.99

- Rain Fee: ₹25.00

- Restaurant GST: ₹14.75

- GST on Rain Fee: ₹4.50

This pushes the total “GST & Other Charges” segment to nearly ₹80, in addition to the cost of food items and delivery.

Consumer Reactions

The development has triggered mixed reactions from users. Many believe that delivery partners deserve additional incentives during rains due to the increased risks and delays, but they argue that such costs should be borne by the platform rather than passed directly to customers.

Social media has seen a surge of criticism, with several users questioning the government’s decision to levy GST on a fee that is meant as a hardship allowance for delivery workers.

Experts Weigh In

Tax experts point out that under GST law, any service charge collected by a platform—whether called a convenience fee, packaging fee, or rain fee—falls under the taxable category. “If Swiggy is collecting it as part of its service to customers, GST automatically applies,” explained a senior chartered accountant.

Consumer rights groups, however, argue that the cumulative effect of such add-on charges is making online food delivery disproportionately expensive. “Transparency is not the issue; affordability is. With every new fee and tax, customers are paying far more than the menu price of food,” said an industry observer.

Read More: CBDT Extends Tax Audit Report Deadline Amid Portal Glitches