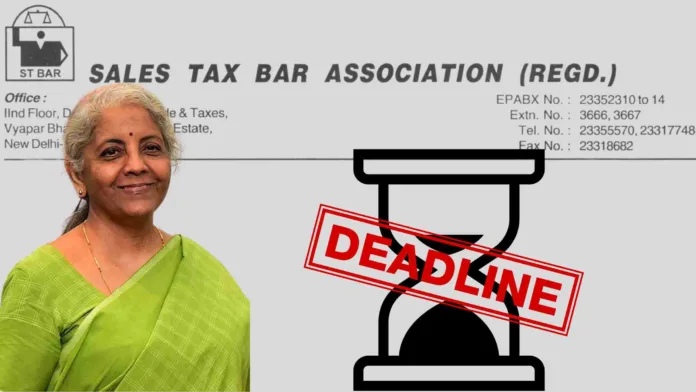

The Sales Tax Bar Association has submitted a representation to the Finance Minfor Extension of Goods and Service Tax (GST) Amnesty Scheme issued under section 128A of the CGST Act.

The Sales Tax Bar Association has submitted a formal representation to Hon’ble Finance Minister Smt. Nirmala Sitharaman, requesting an extension of the GST Amnesty Scheme deadline from March 31, 2025, to June 30, 2025. The appeal highlights the significant challenges faced by taxpayers in availing the scheme and seeks additional time for compliance.

Challenges Faced by Taxpayers

Concerns Raised in Grievance Redressal Committee (GRC) Meeting

In the recent Grievance Redressal Committee (GRC) meeting held on March 27, 2025, various State Commissioners acknowledged the difficulties taxpayers face in opting for the GST Amnesty Scheme. The meeting, which also included industry bodies such as PHD Chamber of Commerce (PHDCC), Confederation of Indian Industry (CII), ASSOCHAM, and FICCI, confirmed that members from different sectors are encountering similar challenges.

Pending Appeals and Financial Burden

A large number of taxpayers have ongoing appeals before appellate authorities and High Courts. Many taxpayers hesitate to make full tax payments under the amnesty scheme, as they anticipate partial relief through appellate decisions. The requirement for an upfront full tax payment poses a significant financial burden, particularly for MSMEs and businesses still recovering from economic setbacks.

Multiple Show Cause Notices (SCNs) on the Same Grounds

Several taxpayers have been issued multiple Show Cause Notices (SCNs) for the same issue, leading to overlapping tax demands. In cases where rectification requests or appeals are still pending for a final order, taxpayers find it unjust to make multiple payments to avail of the amnesty scheme, which results in undue hardship.

Dual Notices/Orders from Central and State Officials

Taxpayers frequently receive notices and orders from both Central and State tax authorities on the same grounds. This dual enforcement results in additional financial strain and legal complexities, making compliance challenging.

Request for Extension of Deadline

Considering these challenges, the Sales Tax Bar Association has urged the government to extend the GST Amnesty Scheme deadline to June 30, 2025. The extension would provide taxpayers with additional time to resolve pending disputes and appeals before making payments. The association believes that an extension will:

- Encourage greater participation in the scheme, leading to higher compliance.

- Increase tax revenue collection for the government.

- Provide taxpayers with a fair opportunity to benefit from the relief offered under the scheme.

The Sales Tax Bar Association has earnestly sought the Finance Minister’s intervention to facilitate a smoother compliance process for taxpayers. The industry awaits the government’s response to their request, hoping for a favorable decision that ensures equitable tax administration.

Read More: Allahabad High Court Bar Association Suspends Strike Amid Inquiry Against Justice Yashwant Varma