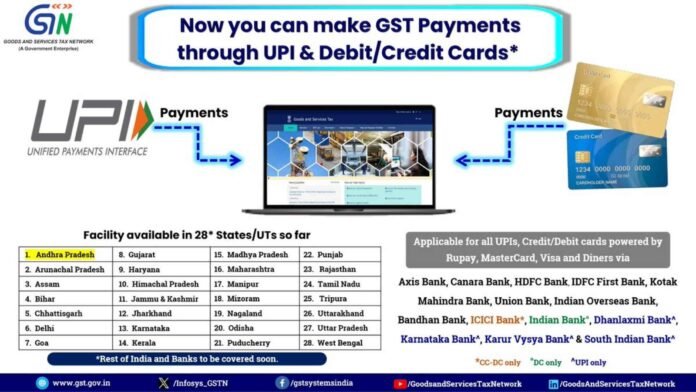

The Goods and Services Tax Network (GSTN) has announced a major expansion in taxpayer convenience by enabling GST payments through Unified Payments Interface (UPI) as well as debit and credit cards across 28 States and Union Territories. The facility is part of GSTN’s ongoing digital enhancement efforts aimed at simplifying tax compliance and reducing dependence on net banking and over-the-counter channels.

This new payment option allows businesses and individuals to make GST payments directly through their preferred UPI apps, or by using credit/debit cards powered by Rupay, MasterCard, Visa, and Diners Club. The system is integrated into the GST portal and supported by a wide network of partnering banks.

Payment Channels Now Active

Under the new system, taxpayers can choose from:

- UPI-based payments

- Debit card payments

- Credit card payments

These options can be accessed directly on the GST portal while generating the challan.

Where the Facility Is Currently Available

The feature is now active in the following 28 States/UTs:

- Andhra Pradesh

- Arunachal Pradesh

- Assam

- Bihar

- Chhattisgarh

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu & Kashmir

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Manipur

- Mizoram

- Nagaland

- Odisha

- Puducherry

- Punjab

- Rajasthan

- Tamil Nadu

- Tripura

- Uttarakhand

- Uttar Pradesh

- West Bengal

GSTN has confirmed that the remaining States and banking partners will be onboarded soon, ensuring nationwide uniformity.

Participating Banks

Payments via UPI and cards are supported by a large network of public and private sector banks, including:

- Axis Bank

- Canara Bank

- HDFC Bank

- IDFC First Bank

- Kotak Mahindra Bank

- Union Bank of India

- Indian Overseas Bank

- Bandhan Bank

- ICICI Bank*

- Indian Bank°

- Dhanlaxmi Bank^

- Karnataka Bank^

- Karur Vysya Bank°

- South Indian Bank^

(* CC & DC only | ° DC only | ^ UPI only)

A Boost to Ease of Doing Business

The introduction of UPI and card-based payment modes marks a significant step toward easing tax compliance for over 1.4 crore registered GST taxpayers. The move is expected to:

- Reduce delays caused by net banking outages

- Enable instant credit of tax payments

- Improve accessibility for MSMEs and first-time taxpayers

- Encourage digital payments in alignment with India’s fintech roadmap

GSTN has also assured continued enhancements to the portal along with the onboarding of additional banks.

Coming Soon

The network confirmed that remaining States and banking partners will be included shortly, enabling seamless UPI and card-based GST payments across the entire country.

Read More: GST | Grounds of Missing DIN or Signature Not Sufficient After Long Delay: Karnataka High Court