Applicant mocks flawed address verification system as GST registration faces rejection due to missed phone call, despite valid location and proof.

In a surprising instance of bureaucratic rigidity, a Goods and Services Tax (GST) registration application has been rejected solely on the ground that the applicant failed to answer a phone call — even though the business address was fully traceable through multiple public and digital sources.

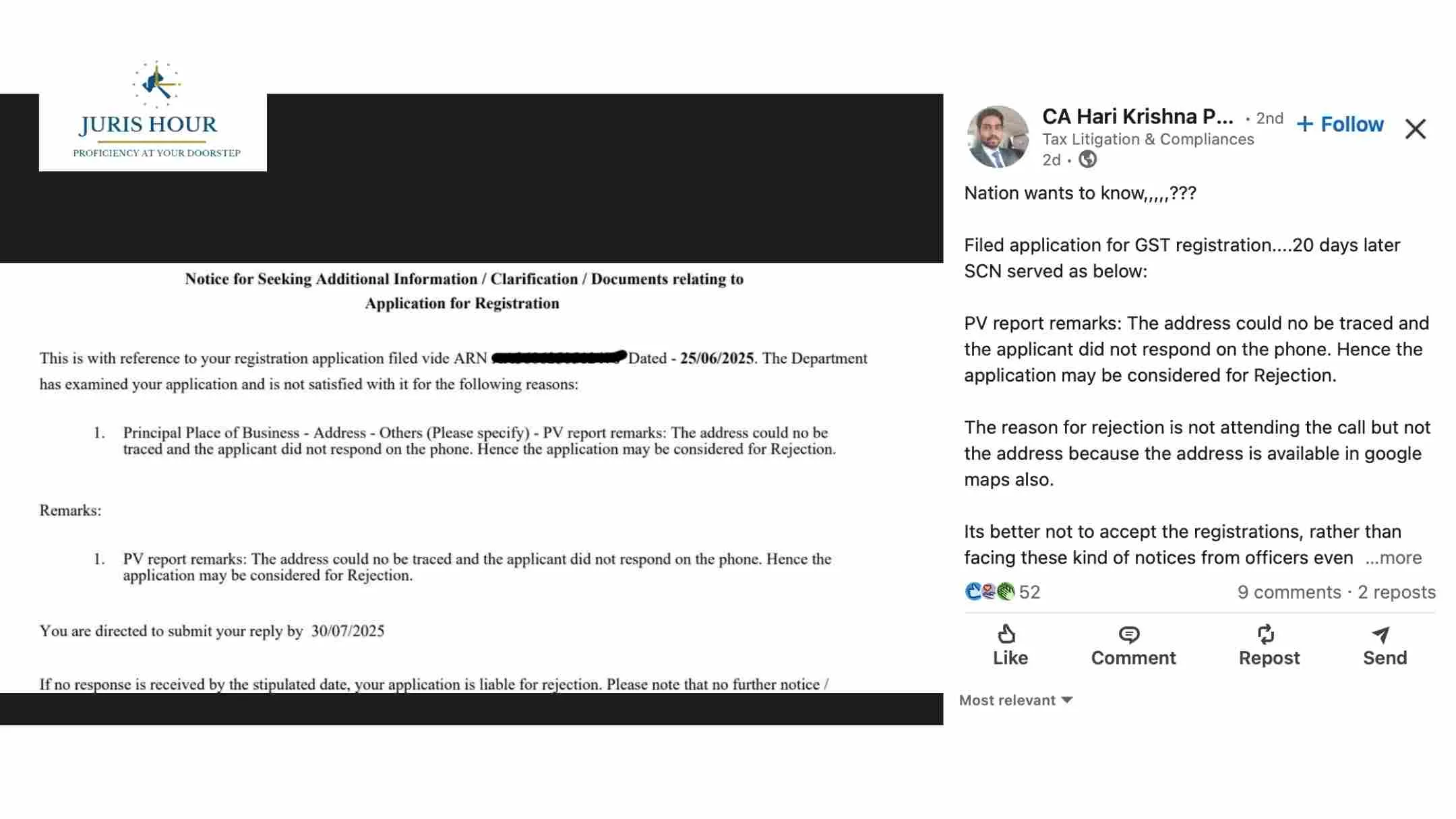

The applicant, who submitted the application in accordance with legal requirements, was issued a Show Cause Notice (SCN) after a 20-day delay. The reason cited by the authorities for potential rejection was as follows:

“The address could not be traced, and the applicant did not respond on the phone. Hence, the application may be considered for rejection.”

What’s striking is that the address is readily visible on Google Maps, and appears in municipal records and major delivery app listings — pointing to a disconnect between digital tools and departmental procedures.

A Witty Rebuttal Sparks a Larger Debate

In response to the notice, the applicant issued a sarcastic yet sharply worded letter addressed to the department, highlighting what many professionals see as a flawed verification process:

“Appreciate the department’s innovative approach to address verification — capable of chasing global tax evasion but stumped by an address visible on Google Maps, municipal records, and food delivery apps.”

The letter dissected the rejection grounds:

- “Address could not be traced” — Suggestions included using navigation tools like Google Maps or India Post’s locator.

- “Call not answered” — A tongue-in-cheek proposal to integrate caller identification apps with GST systems was made.

Supporting documents submitted with the response included:

- A Google Maps screenshot of the location

- An electricity bill for the premises

- A photograph of the applicant in front of the premises holding a current-day newspaper

Questions Raised by the Professional Community

The case has triggered widespread debate among tax professionals and business owners. Many are now questioning whether missing a phone call — often due to poor network or being in meetings — can be considered valid grounds for rejection of GST registration.

Some pointed out the larger issue: if remote or low-network zones are not granted leniency or practical alternatives, entrepreneurs and small businesses in those areas will face undue barriers to formalization and compliance.

Is This the Future of Taxpayer Verification?

The broader concern is that such practices are not isolated. With digitization being a core pillar of India’s tax reform, manual and subjective verifications like these appear increasingly outdated. Critics argue that technology-backed verification — such as GPS tagging, municipal data access, and digital address proofs — should be the norm.

As the satirical response concluded:

“If phone availability is now a legal criterion for business existence, we eagerly await the cancellation of all registrations in low-network zones.”

Conclusion

This incident shines a light on a pressing issue within the GST registration framework — the need for clarity, consistency, and common sense in enforcement. While the government’s intentions may be rooted in preventing misuse, over-reliance on arbitrary factors like phone calls risks alienating genuine taxpayers.

The address exists. The evidence exists.

And now, the nation wants to know — why isn’t that enough?

Read More: Congress Violates Rs. 2,000 Cash Donation Cap: ITAT Upholds Rs. 199 Crore Income Tax Demand