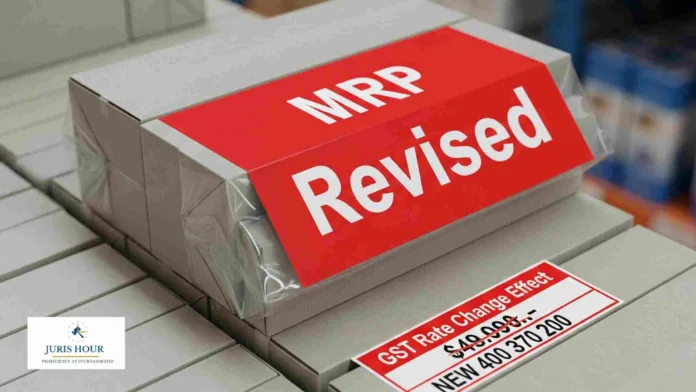

The Ministry of Consumer Affairs, Food and Public Distribution has permitted manufacturers, packers, and importers of pre-packaged commodities to revise the Maximum Retail Price (MRP) on unsold stock in light of recent changes in Goods and Services Tax (GST) rates.

According to a circular issued by the Department of Consumer Affairs’ Legal Metrology Division, the revised MRP can be declared on existing stock manufactured, packed, or imported before the GST revision, by adding or reducing the applicable tax difference. This facility will be available until December 31, 2025, or until the unsold stock is cleared, whichever is earlier.

The declaration of revised MRP must be done through stamping, stickers, or online printing, while ensuring the following safeguards:

Display of Original MRP: The original MRP must remain visible on the package, and the revised MRP should not overwrite it.

Restriction on Price Increase: The revised MRP cannot exceed the extent of tax increase imposed under GST laws. Similarly, in cases of tax reduction, the revised price must reflect the reduced rate and not exceed the permissible difference.

Public Notification: Manufacturers, packers, or importers are required to publish at least two advertisements in newspapers and issue notices to dealers as well as the Director of Legal Metrology, both at the Central and State/UT levels, regarding the price changes.

The circular further clarifies that packaging material or wrappers printed with the old MRP but left unutilized before the GST revision may continue to be used until December 31, 2025, or until such packaging stock is exhausted. However, these packs must also display the revised MRP through proper stamping, stickers, or online corrections, in compliance with GST implementation.