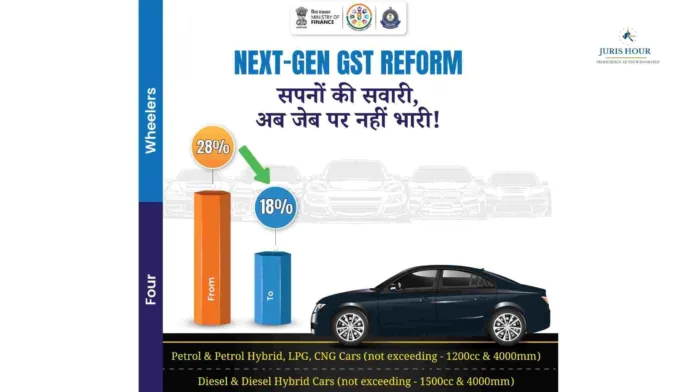

In a major relief for the middle class and automobile industry, the Goods and Services Tax (GST) Council has announced a significant tax cut on small and mid-sized cars. The GST rate on select four-wheelers has been slashed from 28% to 18%, making cars more affordable for consumers.

The announcement, part of the next-generation GST reforms, was made by the Ministry of Finance and the Central Board of Indirect Taxes and Customs (CBIC). The government highlighted the reform with the slogan: “Sapnon ki sawari, ab jeb par nahi bhaari!” (Dream rides, now lighter on the pocket).

Vehicles Covered Under the Tax Cut

The revised GST rates will apply to:

- Petrol & Petrol Hybrid Cars (engine capacity not exceeding 1200cc and length not exceeding 4000mm)

- LPG & CNG Cars (not exceeding 1200cc and 4000mm)

- Diesel & Diesel Hybrid Cars (engine capacity not exceeding 1500cc and length not exceeding 4000mm)

Impact on Consumers

With the new GST structure, the prices of popular hatchbacks, compact sedans, and small SUVs are expected to drop by a substantial margin. Industry experts estimate that cars in the ₹5–12 lakh range could become cheaper by ₹40,000 to ₹1.2 lakh, depending on the model and variant.

Boost for Auto Industry

The automobile sector, which has been grappling with sluggish demand, high input costs, and supply chain challenges, welcomed the decision. Automakers expect the move to significantly revive demand ahead of the festive season.

A senior official from CBIC said:

“The reform will not only benefit consumers but also give a strong push to the automobile sector, which plays a vital role in India’s GDP and employment.”

Wider GST Reform Agenda

This reduction is part of the Council’s broader efforts to rationalize GST slabs, ease compliance, and stimulate consumption. Experts believe that these reforms indicate a shift towards consumer-centric policymaking aimed at boosting economic growth.

Read More: Simplified GST Registration Scheme Launched for Small, Low-Risk Businesses