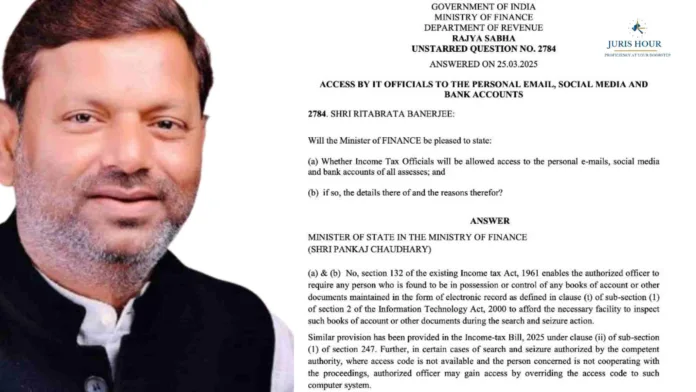

The Government of India has categorically stated that Income Tax officials will not have access to the personal emails, social media accounts, or bank details of taxpayers. This clarification was provided in response to Unstarred Question No. 2784 raised by Shri Ritabrata Banerjee in the Rajya Sabha.

In a written reply, Minister of State for Finance, Shri Pankaj Chaudhary, affirmed that under the existing Income Tax Act, 1961, authorities can only inspect electronic records related to books of accounts or other financial documents during search and seizure operations. This is in accordance with Section 132 of the Income Tax Act and Section 2(t)(1) of the Information Technology Act, 2000.

It was speculated that under the proposed Income Tax Bill, the government has expanded the investigative reach of tax officials, allowing them to scrutinize social media profiles, emails, bank accounts, online investment portfolios, and trading accounts. The amendment brings the Income Tax Department in line with the digital age but raises critical questions about data security and personal privacy.

New Provisions in Income-tax Bill, 2025

The government further highlighted that the upcoming Income-tax Bill, 2025, proposes a similar provision under Clause (ii) of Sub-section (1) of Section 247. In situations where a taxpayer does not cooperate during a search and seizure operation, the authorized officer may direct them to provide the necessary access codes to their electronic records.

Key Takeaways

- No blanket access: Income Tax officials cannot directly access personal emails, social media, or bank accounts.

- Restricted to financial records: Only electronic records of books of accounts or other relevant documents can be inspected.

- New tax bill provisions: The proposed Income-tax Bill, 2025, may allow authorities to order access codes during search and seizure.

This clarification provides relief to taxpayers concerned about potential privacy infringements while ensuring compliance with tax laws.

Read More: Redevelopment Flat Value Not To Be Taxed U/s 56(2)(X) Of Income Tax Act: ITAT