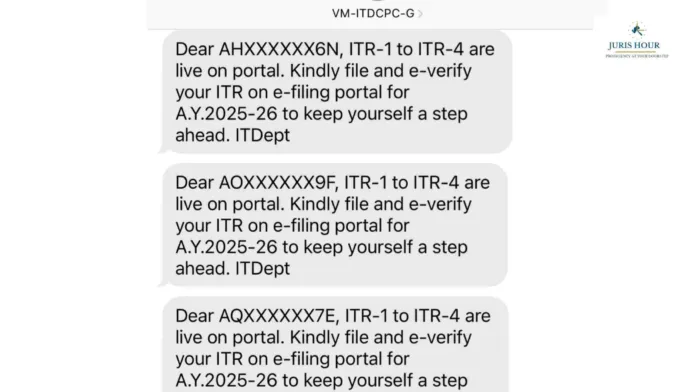

The Income Tax Department has begun dispatching SMS notifications to taxpayers who have not yet filed their Income Tax Returns (ITR). These messages are reminding taxpayers of the upcoming final deadline of September 15, 2025, and urging them to file early—ideally in August—to avoid interest on pending tax dues.

Tax authorities are wary of last-minute rushes and late filings, which can attract not only interest but also penalties. As of now, ITR can be filed using either the online portal or offline utilities released by the department. Experts strongly recommend filing ahead of time, as post-deadline filings often incur additional liabilities and processing delays.

According to recent guidelines, when filing under the old tax regime, taxpayers must submit detailed documentation—such as insurance policy numbers, housing loan details, landlord information for HRA, PPF account numbers, health insurer details, and political donation registration numbers—to substantiate deduction claims.

In response to misfiling and fraudulent claims, the department has also taken strict action. A crackdown on ITR preparers and intermediaries revealed misuse of bogus exemptions and deductions. This resulted in penalties and legal proceedings, though thousands of taxpayers voluntarily corrected their returns following reminders and outreach campaigns.

This year’s SMS campaign aligns with earlier e‑campaigns—where the CBDT used SMS and email to flag mismatches between AIS (Annual Information Statements) and filed ITRs, urging affected individuals to file revised or belated returns—but those were for FY 2023‑24, with deadlines of December 31, 2024.

Don’t wait for September 15. File in August to avoid stress, penalties, and interest.

How to File Your ITR — Step-by-Step Guide

Here’s a researched, in-depth breakdown to help you file your Income Tax Return smoothly and accurately:

1. Gather Your Documents

- Common documents include Form 16 (for salaried individuals), bank statements, interest certificates, Form 26AS, and Annual Information Statement (AIS).

2. Log In or Register on the Income Tax e-Filing Portal

- Visit the official portal and use your PAN, Aadhaar (if linked), and password to log in.

- New users need to register by validating PAN, mobile number, and email via OTP, then set your login credentials.

3. Select Assessment Year & Filing Mode

- Choose the correct Assessment Year, e.g., AY 2025‑26 for FY 2024‑25.

- Opt for Online Filing (through the portal) or Offline Filing (via Excel or JSON utility; upload after filling).

4. Choose the Right ITR Form

- For salaried individuals with simple income: ITR‑1 (Sahaj)—for salary, one house property, exempt LTCG under Section 112A, and other sources.

- For other income sources (e.g., freelancing, multiple properties): ITR‑2, ITR‑3, or ITR‑4 (Sugam)—depending on the nature of your income.

- New simplified eligibility allows those with non-taxable LTCG up to ₹1.25 lakh to file ITR‑1 via Excel utility.

5. Fill in the ITR Form

- The portal auto-fills your personal and AIS info; verify and correct if needed.

- Fill in income details (salary, house property, LTCG, etc.), deductions (Sections 80C, 80D, etc.), TDS credits, and tax paid.

- For old regime, ensure you have all required deduction documentation ready.

6. Review, Validate, and Submit

- Preview your form, resolve any validation errors, and ensure the tax liability matches your calculations.

- Submit once all data is accurate.

7. E‑Verify Your Return

- Immediately verify your return via Aadhaar OTP, EVC (via net banking, bank/demat), or DSC.

- Or choose to verify later via ITR‑V (by sending a hard copy to CPC, Bengaluru).

8. Keep Records & Respond to Notices

- Save your acknowledgment and keep documentation.

- In case of any outstanding demand or mismatch notice, log in and check ‘Pending Actions’ to respond or pay promptly.

Summary Table

| Step | Action |

| 1 | Gather documents |

| 2 | Register/Log in to portal |

| 3 | Select assessment year & filing mode |

| 4 | Choose correct ITR form |

| 5 | Fill income and deduction details |

| 6 | Review & submit form |

| 7 | E‑verify or send ITR‑V |

| 8 | Respond to any notices or demands |

By following these steps now—especially filing in August—you not only avoid interest and penalties but also gain peace of mind. Let me know if you’d like help choosing the right form or walkthrough for any specific step!

Read More: Defamation Complaint Over Impotency Allegations Made in Matrimonial Disputes Quashed: Bombay HC