Directorate of Enforcement (ED), Shimla has conducted search operations on 19.09.2025 and 20.09.2025 at six premises located in Himachal Pradesh and Delhi belonging to Manavinder Singh, his wife Sagri Singh and related entities/persons in the Imperial Group which is based out of Delhi.

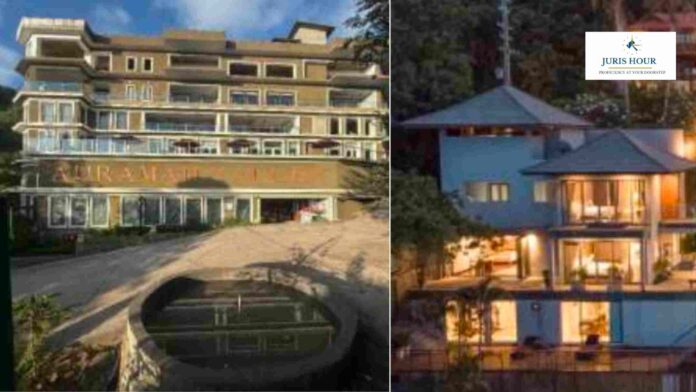

The search operations were conducted under the provisions of Foreign Exchange Management Act (FEMA), 1999 in connection with an investigation relating to undisclosed assets held outside India, undisclosed foreign investments and financial interests of Manavinder Singh, his wife Sagri Singh and the companies operating under the Imperial Group.The Imperial Group is a group of companies operating inter-alia in the aerospace and real estate sectors and is chaired by Manavinder Singh. The Auramah Valley luxury residential project located in Naldehra, Himachal Pradesh is also part of the aforesaid group and is owned by Manavinder Singh.

ED initiated investigation in the matter on the basis of intelligence relating to the presence of undisclosed foreign assets / undisclosed financial interests in companies abroad in the names of Manavinder Singh, his wife Sagri Singh and certain companies operating under the Imperial Group.

During the search operations conducted by ED, evidences relating to undisclosed foreign financial interests / assets being held abroad and undisclosed foreign bank accounts being held in the name of Manavinder Singh (including foreign bank account passbooks)have been seized.

Further, the following foreign assets and interests in foreign companies have also been revealed during the search operations:

- Undisclosed financial interest in Aerostar Venture Pte Ltd located in Singapore, wherein, both Manavinder Singh and Sagri Singh are beneficial owners and Manavinder Singh is the only Director.

- Undisclosed financial interest in United Aerospace DWC LLC located in Dubai, wherein, both Manavinder Singh and Sagri Singh are beneficial owners and Manavinder Singh is the only Director. Further, it has been revealed that a complex web of transactions has been created using United Aerospace DWC LLC, Dubaiand unsecured loans in crores of INR are being advanced to / salary paymentsin crores of INR are being made to Manavinder Singh, Sagri Singh and related Indian entities in which they are beneficial owners.

A Helicopter (Robinson 66) worth Rs. 7 Crore has also been purchased in May 2025 by United Aerospace DWC LLC by purportedly availing of an unsecured loan of Rs. 7 Crore from an unnamed Hong Kong based entity.

The helicopter has been imported into India for residents of the Auramah Valley residential project through an arrangement wherein lease payments from this Indian residential project are flowing back to the Dubai based United Aero space thereby leading to accumulation of even more undisclosed foreign assets in this Dubai based entity. Further, it has also been unearthed during the search operations that assets worth Rs. 38 Crore are being held by this Dubai based entity as on 31/3/2025.

- Undisclosed foreign asset in the form of “Villa Samayra” located in Koh Samui, Thailand wherein Manavinder Singh, Sagri Singh and their family members are beneficial owners. It has been revealed that this villa is worth more than Rs. 16 Crore as on date.

- Undisclosed foreign assets / financial interests in companies located in British Virgin Islands and undisclosed foreign bank accounts in Singapore, wherein, both Manavinder Singh and Sagri Singh are beneficial owners.

According to the seized financial statements and seized records pertaining to the above undisclosed foreign entities and undisclosed assets held outside India, it is estimated that the value of these undisclosed foreign financial assets / interests / bank accounts located in Singapore, Dubai, British Virgin Islands and Thailandismore than Rs. 80 Crore.

Further, during the search operations conducted at the premises of Auramah Valley residential project in Naldehra, Himachal Pradesh, it was further revealed that part sale consideration for the flats in the said residential project is being received in cash. According to the parallel books of accounts being maintained at the said premise, it was revealed that cash amounting to Rs. 29 Crore has already been received in the said residential project through the above modus.

Hence, as per the investigation done till now, the modus operandi being followed by Manavinder Singh / the Imperial Group is indicative towards the use of hawala and / or other means to send the cash generated through the real estate and / or other activities of the Imperial Group outside of India which is then followed by either:

- Purchase of undisclosed assets outside India in the names of Manavinder Singh, Sagri Singh, their family members and Indian entities operating under the Imperial Group. These assets are revenue generating which in turn lead to accumulation of even more undisclosed foreign assets or

- Round tripping of the funds back to Manavinder Singh, Sagri Singh and Indian entities under the Imperial Group through the use of undisclosed financial interests in foreign companies which are being ultimately controlled and managed by Manavinder Singh / Sagri Singh.

The total cash seized during the search operations is Rs. 50 Lakh (approx.) in Indian currency (including cash of Rs. 50,000/ seized in old 500-rupee currency notes) in addition to seized foreign currency of USD 14,700.

Further, 3 lockers have also been frozen during the search operations and various incriminating records and digital evidences relating to Manavinder Singh, Sagri Singh and the Imperial Group have been seized.

Further investigation is under progress.

Click Here To Read Press Release

Read More: AP High Court Quashes Export Duty on DTA to SEZ Supplies