Despite the lack of executive authority, Dhankhar leveraged his public platform to influence taxation discourse

In a surprising development, Vice President of India Jagdeep Dhankhar resigned from his post today, marking the end of a tenure defined by his strong advocacy for ethical tax practices, economic nationalism, and public trust in the country’s revenue administration. While the Vice President holds no formal constitutional powers over taxation, Dhankhar played an influential moral and advisory role through frequent public engagements and speeches that emphasized reform, integrity, and transparency in tax governance.

Constitutionally: No Direct Role in Taxation

According to the Indian Constitution, the power to levy and manage taxes resides with the Parliament, not individual constitutional functionaries like the Vice President. Dhankhar did not oversee tax collection, policymaking, audits, or adjudication. These responsibilities are managed by bodies such as the Central Board of Direct Taxes (CBDT), the Income Tax Department, and the Ministry of Finance.

From Public Speeches: Championing Tax Compliance and Trust

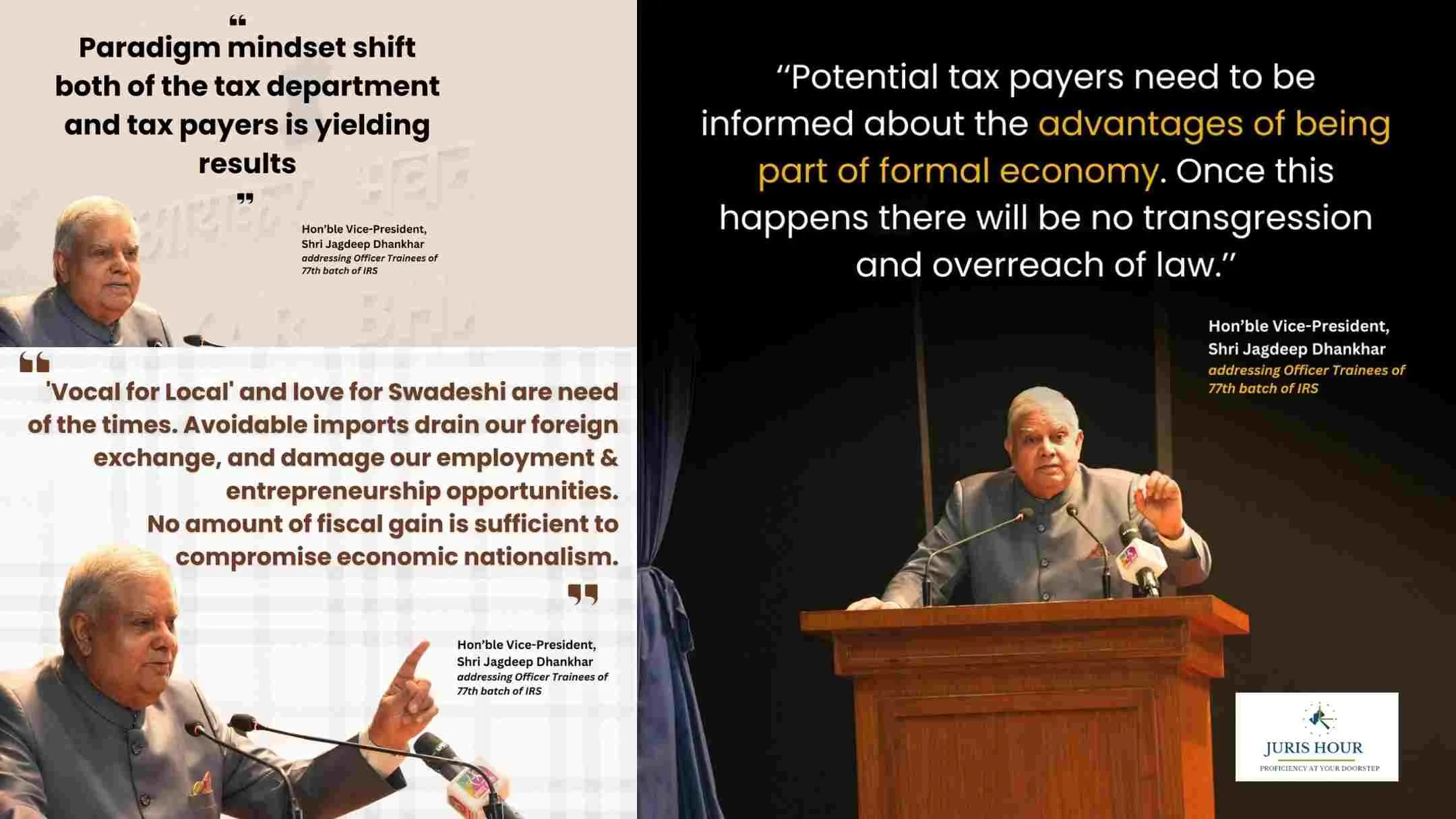

Despite having no administrative authority over taxation, Dhankhar used his platform to promote key tax-related principles:

1. Promoting Voluntary Tax Compliance

During addresses to IRS officers and civil service trainees, Dhankhar consistently encouraged the expansion of India’s tax base through counselling rather than coercion, highlighting the untapped potential in a population exceeding 1.4 billion. He emphasized persuasion and trust over fear and penalties.

2. Advocating Economic Nationalism

He was a vocal proponent of “Vocal for Local” and Swadeshi policies, urging tax authorities and economic professionals to promote domestic industry, conserve foreign exchange, and curb unnecessary imports.

3. Supporting Digital Transformation

Dhankhar commended initiatives such as Faceless E‑Assessment, PAN-Aadhaar linking, and digital return filing systems. He viewed these efforts as critical to building a user-friendly and transparent tax environment in India.

4. Calling for Ethical Conduct Among Professionals

At professional forums including chartered accountant conventions, he reminded financial professionals of their moral duties—emphasizing the need to choose tax planning over evasion, promote transparency, and uphold public trust.

Summary: Symbolic But Powerful Influence on Tax Policy Discourse

| Domain | Vice President Dhankhar’s Role |

| Constitutional/Legal | No statutory or executive control over tax laws or enforcement mechanisms. |

| Advisory/Speeches | Strong advocate for expanding the taxpayer base, voluntary compliance, and ethical professional conduct. |

| Symbolic Leadership | Promoted public confidence in the tax system through speeches and public engagement. |

A Legacy That Goes Beyond Office

Although Jagdeep Dhankhar’s resignation marks the end of his formal role in India’s constitutional framework, his consistent messaging on taxpayer dignity, ethical governance, and national economic interest has left a lasting impression on both the tax administration and the public. His tenure reinforced the idea that leadership in governance extends beyond statutory power—it also includes the responsibility to shape values, practices, and the spirit of public service.

Read More: Jagdeep Dhankhar Resigns as Vice President of India, Cites Health Reasons [READ RESIGNATION]