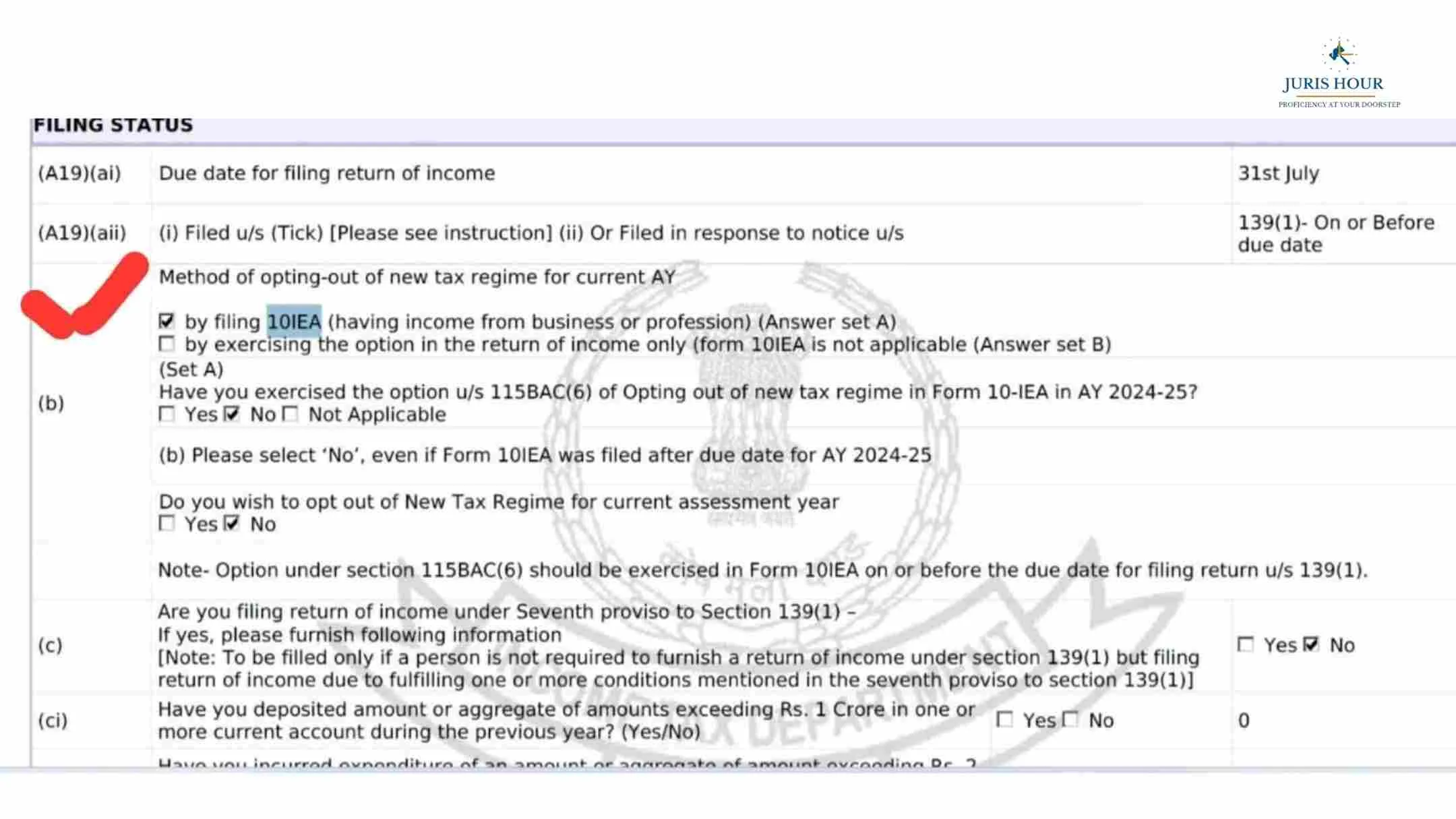

A recent update to the Income Tax Return (ITR) Form 3 for the Assessment Year (AY) 2025–26 has triggered confusion and frustration among tax professionals and taxpayers. The form now mandates an answer to a question regarding the “Method of Opting Out of the New Tax Regime”, even for those who have not opted out or intend to stay under the new regime by default.

Prominent Chartered Accountant CA Harshil Sheth brought the issue to light on social media, questioning the logic behind forcing users to respond to an opt-out-related query when both the current and previous years already had the new tax regime as default.

“ITR 3 is asking to compulsory answer questions related to Method of OPTING OUT new regime in Current AY (even if u don’t wish to opt out),” Sheth tweeted, further adding, “Why? Why this does not have NOT APPLICABLE AS OPTION?”

The tweet, which quickly gained traction among tax professionals and taxpayers, tags key officials and handles, including @IncomeTaxIndia, urging them to fix the oversight.

No ‘Not Applicable’ Option

The primary concern is the absence of a ‘Not Applicable’ option in the dropdown menu, forcing all users to choose a method of opting out—even if they haven’t. This could potentially lead to misreporting or errors in filing, increasing the risk of notices or mismatches during scrutiny.

Industry Reaction

The tax community has expressed dismay over this technical glitch, especially during a peak filing period. Several practitioners noted that such mandatory questions without logical branching only add to taxpayers’ burden and create scope for unnecessary compliance hurdles.

Call for Immediate Rectification

Tax professionals are now urging the Central Board of Direct Taxes (CBDT) and Income Tax e-Filing portal authorities to:

- Add a ‘Not Applicable’ option immediately.

- Ensure intelligent form logic that adapts based on the taxpayer’s chosen regime.

- Avoid such errors in future updates, particularly close to filing deadlines.

As the July 31st deadline approaches for non-audit taxpayers, clarity and resolution on this matter is crucial to ensure a smooth and error-free filing process.

Read More: Custom Duty & IGST Shock: Indian Consumer Pays ₹11,800 on ₹25,000 Camera Gear Imported from USA