Fear of GST notices pushes vendors back to cash transactions as digital payments attract tax scrutiny.

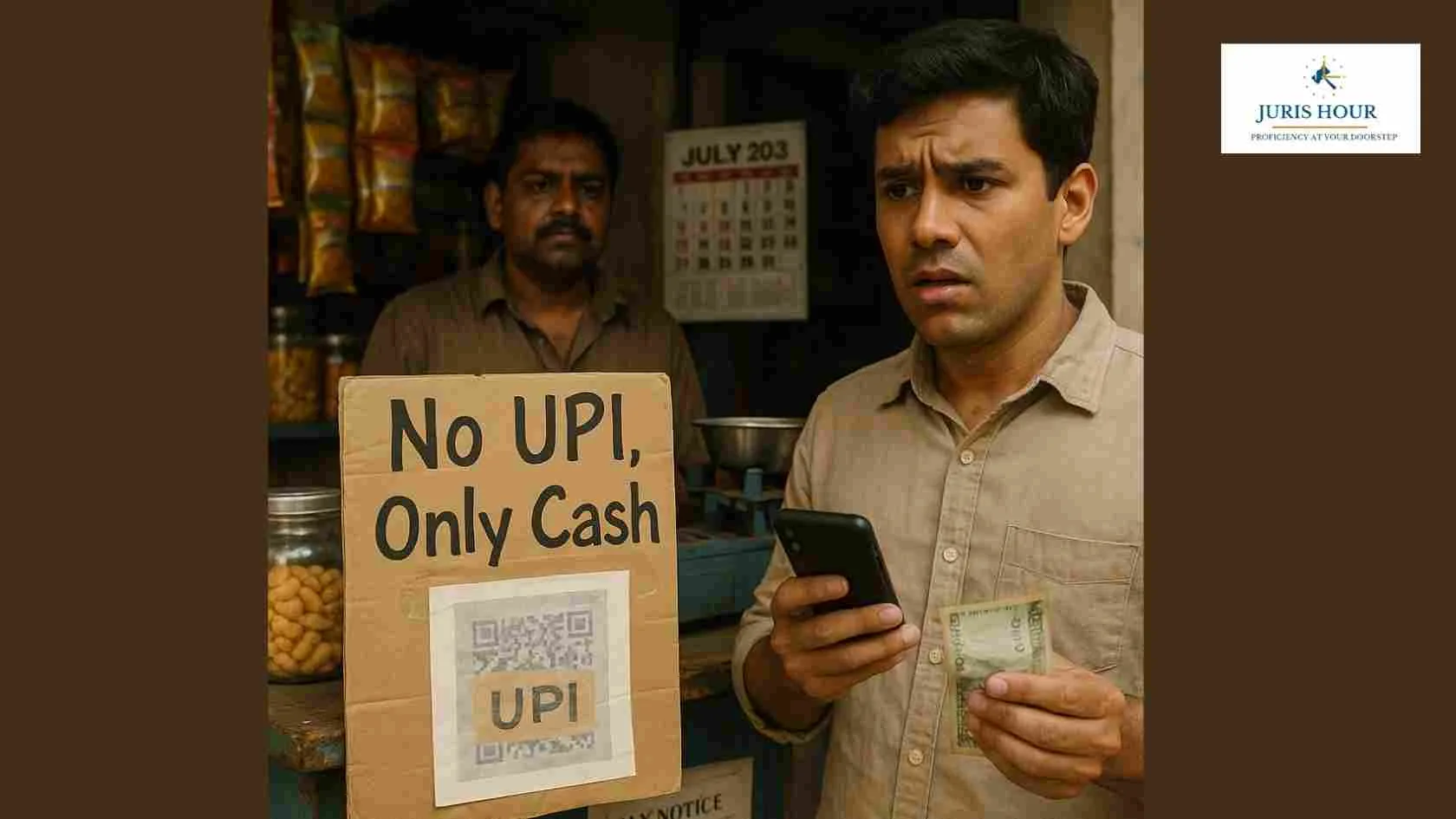

In a surprising shift from its digital-first reputation, many small businesses across Bengaluru are reverting to cash-only transactions, replacing familiar QR code stickers with handwritten signs that read “No UPI, only cash.”

Street vendors, pushcart sellers, and small shopkeepers who once welcomed Unified Payments Interface (UPI) transactions are now increasingly refusing digital payments. The reason? A growing fear of scrutiny from tax authorities.

Many of these micro-entrepreneurs have received goods and services tax (GST) notices, some demanding payments running into lakhs of rupees. According to vendors and professionals assisting them, the surge in digital transactions has brought them under the tax department’s radar — often without their knowledge that they had crossed the mandatory registration threshold under GST.

As per current GST regulations, businesses supplying goods must register and pay taxes if their annual turnover exceeds ₹40 lakh, while the limit for service providers stands at ₹20 lakh. Authorities have issued notices based on UPI transaction data since 2021-22, claiming that in many cases, the receipts indicated a turnover above the prescribed threshold.

However, experts point out that not all money received via payment apps reflects business income. Personal transfers, informal loans, and even family contributions often get mixed with business payments, making the total appear inflated. There are concerns that tax demands have been raised without sufficient investigation or proof, putting the onus of clarification entirely on small business owners.

The fear of harassment and potential eviction by local authorities has led to widespread anxiety, prompting many to avoid digital transactions altogether. Several chartered accountants believe Bengaluru could become a model for similar crackdowns across other Indian states, given the pressure on state governments to boost tax collections.

With mounting welfare commitments and infrastructure needs, Karnataka’s tax machinery is under pressure to meet ambitious revenue targets. In this context, small vendors find themselves caught between financial survival and regulatory compliance — choosing to step back from digital platforms that once promised ease, transparency, and inclusion.

Read More: Fresh Plea For Provisional Release Despite GST Confiscation Proceedings Allowed: Kerala High Court