The Income Tax Department has collected a total of ₹2,336 crore from taxpayers as fees for delayed linking of Aadhaar with Permanent Account Number (PAN), the government informed Parliament.

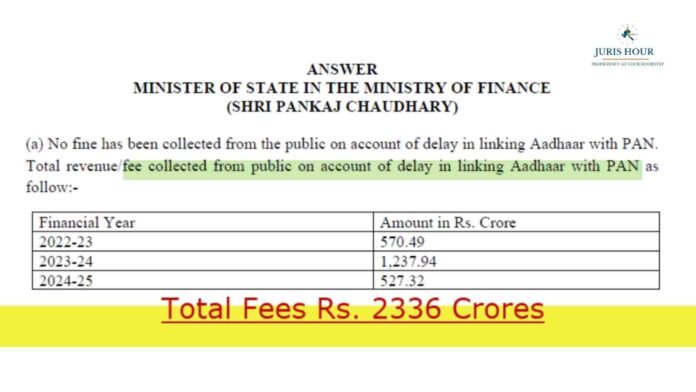

The information was provided by the Minister of State in the Ministry of Finance, Shri Pankaj Chaudhary, in a written reply to a question in the Lok Sabha.

Clarifying the nature of the collection, the Minister stated that no fine or penalty has been imposed on the public for the delay. Instead, the amount represents fees collected for late linking of Aadhaar with PAN, as prescribed under the Income-tax Act.

Year-wise Collection Details

According to the data placed before Parliament, the fee collections are as follows:

- FY 2022–23: ₹570.49 crore

- FY 2023–24: ₹1,237.94 crore

- FY 2024–25: ₹527.32 crore

The cumulative collection across the three financial years amounts to ₹2,336 crore.

Background

Linking Aadhaar with PAN was made mandatory to curb tax evasion and ensure better compliance. Taxpayers who failed to complete the linkage within the stipulated timelines were required to pay a prescribed fee to validate their PAN.

While the government has maintained that the fee is a compliance-related charge and not punitive in nature, the quantum of collections has sparked debate, particularly over the impact on economically weaker taxpayers and those facing digital access constraints.

The disclosure has renewed discussions on whether compliance fees of this scale align with the objective of inclusive and taxpayer-friendly governance, especially when PAN is essential for banking, investments, and tax filings.

Read More: Finance Bill, 2025 Doesn’t Alter Pension Structure Under 8th Pay Commission