India’s Goods and Services Tax (GST) framework has entered a decisive phase of enforcement as thousands of fake invoice rackets are being detected through advanced digital surveillance, data analytics, and artificial intelligence deployed by the GST Network (GSTN). Authorities say the collapse of these rackets is no longer dependent on physical raids alone but is driven primarily by data trails that leave little room for manipulation.

Over the past few years, the GST ecosystem has transformed into a fully digitised compliance and enforcement platform where every transaction, return, and credit claim is continuously analysed in real time. As a result, GST registration cancellations have increased sharply, particularly in cases involving fake billing and fraudulent Input Tax Credit (ITC) claims.

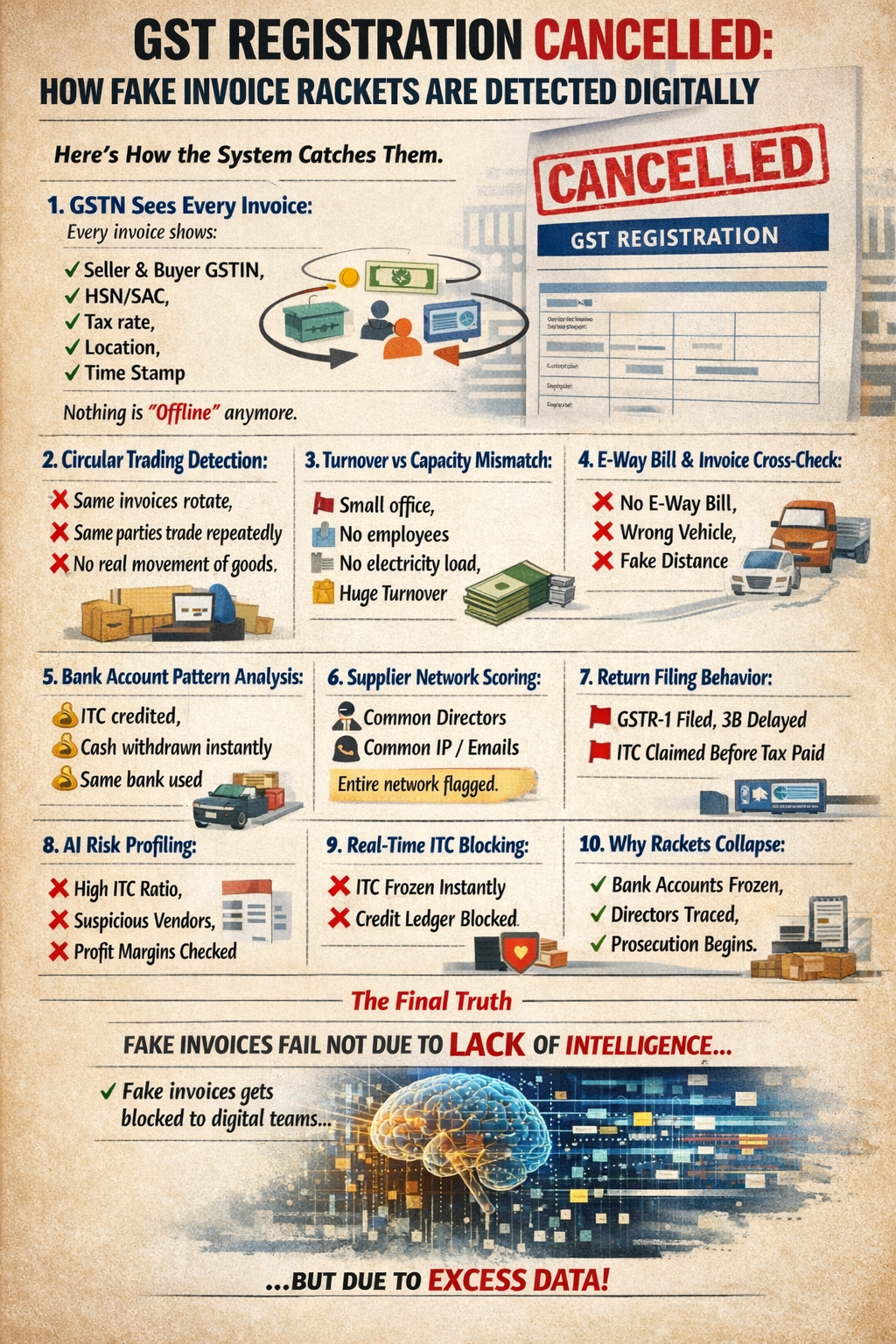

Every Invoice Is Digitally Visible to GSTN

At the heart of GST enforcement lies complete invoice visibility. Every invoice uploaded on the GST portal carries granular data, including the seller and buyer GSTINs, HSN or SAC codes, applicable tax rates, place of supply, and exact time stamps. Once uploaded, invoices become part of a national data pool accessible to tax authorities across jurisdictions.

Officials point out that the GST regime has eliminated the concept of “offline” transactions. Even a single invoice that appears inconsistent with historical patterns can trigger system-generated alerts.

Circular Trading: A Key Red Flag

One of the most common methods used by fake invoice rackets—circular trading—is now easily detected digitally. The system flags transactions where the same invoices rotate among a closed group of entities, the same parties repeatedly trade with each other, and there is no actual movement of goods.

Such transactions often show high ITC claims without corresponding economic substance. Once identified, the entire trading loop comes under scrutiny, not just a single GSTIN.

Turnover vs Capacity Mismatch Raises Instant Alerts

Digital risk engines also compare declared turnover with the physical and operational capacity of a business. Red flags are raised when entities with minimal infrastructure—such as small rented offices, no employees, negligible electricity consumption, or no manufacturing capacity—report disproportionately high turnover.

These mismatches generate automated risk scores, often leading to physical verification, suspension of registration, or immediate blocking of ITC.

E-Way Bill and Invoice Cross-Verification

The integration of e-way bill data with invoice reporting has significantly tightened enforcement. Authorities track whether invoices raised are supported by valid e-way bills, correct vehicle numbers, realistic distances, and genuine movement of goods.

Patterns such as repeated use of the same vehicle across multiple firms, fake distance mapping, or complete absence of e-way bills are considered strong indicators of fictitious supply.

Bank Account Pattern Analysis Exposes Money Trails

Fake invoice rackets are increasingly exposed through financial intelligence. GST systems analyse banking behaviour, identifying cases where ITC amounts are credited and withdrawn immediately, funds are rotated back in cash, or the same bank accounts are used across multiple interconnected firms.

According to officials, while invoices can be fabricated, money trails rarely lie. Once suspicious banking patterns emerge, accounts are frozen in coordination with enforcement agencies.

Supplier Network Mapping and Common Links

GSTN now maps entire supplier networks rather than examining entities in isolation. Common directors, shared IP addresses, identical mobile numbers or email IDs, and even the same chartered accountants or auditors across multiple firms trigger network-wide alerts.

As a result, the detection of one fake firm often leads to the suspension or blocking of an entire cluster of connected GST registrations.

Return Filing Behaviour Under Scrutiny

Return filing patterns have become a crucial indicator of fraud. Authorities closely watch cases where GSTR-1 is filed on time but GSTR-3B is delayed, ITC is claimed before tax is actually paid, or nil returns are filed immediately after periods of heavy billing.

Such inconsistencies are now algorithmically identified as classic indicators of shell entities created solely for generating fake invoices.

AI-Driven Risk Profiling Changes Enforcement

Every GSTIN is assigned a dynamic risk score based on multiple parameters, including ITC ratios, filing discipline, vendor quality, profit margins, and historical compliance. High-risk scores often lead to search operations, suspension of registration, issuance of show cause notices, and initiation of recovery proceedings.

This shift towards predictive enforcement has significantly reduced the time gap between fraud and detection.

Real-Time ITC Blocking Under Rule 86A

Perhaps the most disruptive tool in the enforcement arsenal is real-time ITC blocking under Rule 86A of the CGST Rules. Once triggered, ITC is blocked instantly, electronic credit ledgers are frozen, and businesses are effectively paralysed—often without prior notice.

Tax officials emphasise that Rule 86A has been instrumental in preventing further revenue leakage while investigations are ongoing.

Why Fake Invoice Rackets Collapse Completely

Once detected, fake invoice operations rarely survive. Bank accounts are frozen, GST registrations are cancelled, directors and key persons are traced, and past years’ returns are reopened. In serious cases, prosecution under GST law and allied statutes follows.

Authorities note that these rackets collapse not due to a lack of sophistication but due to the sheer volume of digital data they generate.

The Final Reality

Experts conclude that fake invoices fail not because fraudsters lack intelligence, but because the GST ecosystem is now built on excess data, constant cross-verification, and automated risk analysis. In a system where every transaction leaves a digital footprint, sustained tax evasion has become increasingly difficult.

As India strengthens its digital tax infrastructure, the message from enforcement agencies is clear: technology, not discretion, now drives GST compliance.