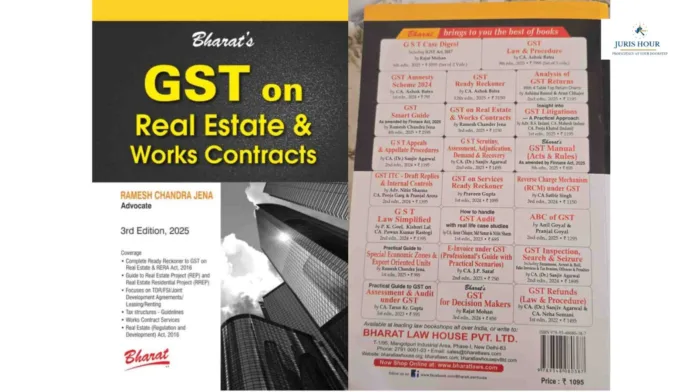

The 3rd Edition of “GST on Real Estate & Works Contracts” authored by Advocate Ramesh Chandra Jena and released by Bharat Law House Pvt. Ltd. is an in-depth and timely tool for practitioners, lawyers, and developers dealing with GST in real estate and construction. The book covers practical issues as well as compliance matters going concerts and those related to construction as seen by the issues which have arisen since 2019, the content is immediately relevant to presently practicing professionals.

Content and Structure:

The book contents are carefully divided into two parts, as follow :

- Part I: The GST Basics

This part will give readers the crucial fundamentals for GST about supply, time and place of supply, valuation, input tax credit, e-way bills and the procedural aspects to build a solid conceptual basis.

- Part 2: Sector-based coverage

Part 2 focuses on in-depth commentary on real estate and works contracts including Joint Development Agreements, Real Estate Projects (REP, RREP), Affordable Housing, Transfer of Development Rights (TDR) and lease, rent and sale of land under RERA, GST implications on cooperative housing societies and so on.

Key messages from the preface:

In the April 21, 2025, preface to this second edition the author emphasizes how he worked to align it with recent legislative and procedural developments. The book, according to the author, kay comprehensive emphasis on the provisions of Schedules I, II and III of the CGST Act as well as in relation to relevant updated rules on valuation and compliance.

About the Author:

Ramesh Chandra Jena is an experienced indirect taxation practitioner for over 34 years across industries like textiles, steel, automobile, and power. He is a prolific author of more than 500 technical articles and currently works as an advocate in the Orissa High Court. He is a member of GST Grievance Redressal Committee in Bhubaneswar, thus further strengthening its credibility and domain expertise.

Some strength of the book:

Source updated content for post 2019 amendments

Real life illustrations and examples from varieties of sectors

Navigable structure for quick reference

Incorporation of various board circulars and FAQ’s and judicial pronouncements

Practical guide for professionals in real estate and infrastructure

Ideal for:

- Chartered Accountants

- Indirect Tax Lawyers

- Developers and Builders Compliance and Finance Personnel

- Law and Commerce students

Where to Buy:

Available on Amazon for purchase:

Conclusion

Ramesh Chandra Jena’s “GST on Real Estate and Works Contracts” book in Bharat, is comprehensive, practical and authoritative work, which is way ahead making the connection between law and practice. It is a good addition to the library of any professional engaged in real estate taxation and contract compliance under GST.