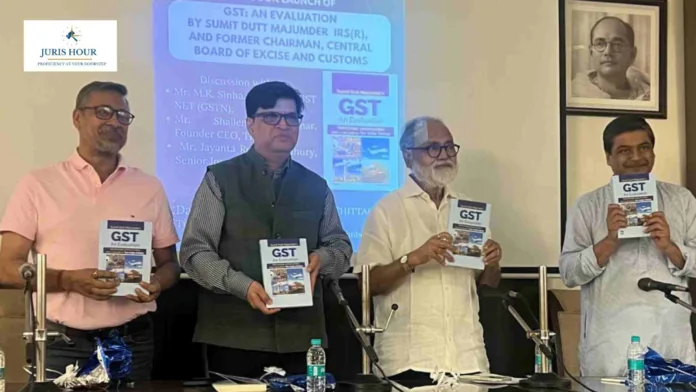

In a momentous gathering of tax experts, bureaucrats, and thought leaders, Mr. Sumit Dutt Majumder, former Chairman of the Central Board of Excise and Customs (CBEC), unveiled his fifth and most anticipated book titled “GST After About Eight Years – An Evaluation” at a well-attended event in Delhi.

The book launch brought together some of the most respected voices in India’s indirect tax ecosystem. The event was moderated by the author, Mr. Sumit Dutt Majumder, who steered the conversation with insightful observations and critical reflections on the evolution of GST in India since its rollout in July 2017.

Sumit Dutt Majumder said, “the discussion of GST started long time back but finally it was announced in 2006 budget by the then Finance Minister P. Chidambaram, he said that we have decided to bring in GST and fixed the date in 2010”.

Delivering the keynote address, Mr. M.K. Sinha, IRS, CEO of the GST Network (GSTN), highlighted, “it was the best possible design and the IGST model which is the central model by which taxes move from exporting state to importing state and at the end of the month the money is settled was decided and formalised after seven hours of discussion in which at least 9 different global model was studied under Dr. Aseem Das Gupta”.

Mr. Shailendra Kumar, Founder & CEO of Tax India Online (TIOL), brought his sharp editorial insight to the discussion, by commenting that though GST is fast stabilising & living up close to Revenue’s expectations but it has also developed cracks in its basic design. And these cracks have been propelling it off the trajectory. The most scary crack has popped up in its vertebrate i.e. the ITC. Apart from the credit blocked in the law, Rules were made to block more of it. Secondly, soaring litigation related to credit showcases flaws in implementation.

The discussion traversed key themes covered in the book. The book is poised to serve as an essential resource for tax professionals, policymakers, economists, and legal scholars.

The event was organized under the aegis of the Deshbandhu Chittaranjan Memorial Society, of which Mr. Majumder is currently the Chairman of the Committee of Trustees.

About the Book:

“GST After About Eight Years – An Evaluation” offers a comprehensive analysis of India’s Goods and Services Tax system through the lens of someone who helped shape its foundational stages. With candid commentary, supported by data, the book contributes significantly to the growing body of literature on Indian fiscal federalism.

Read More: Edible Oil Entrepreneurs Will Now Get GST Refund Of Crores Of Rupees Stuck