Section 88 of CGST Act Inapplicable for Recovery of Central Excise Dues from Directors Of Liquidated Company: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that Section 88 of CGST Act is inapplicable for recovery of central excise dues...

This Is Why Madras High Court Reduces Pre-Deposit From 25% To 10%

Citing the established practice of the Madras High Court, which typically directs a 10% pre-deposit when appeals are...

Assessee Can’t Be Permitted To Frustrate Adjudicatory Process Provided In GST Act: Calcutta High Court

The Calcutta High Court has held that assessees cannot be permitted to frustrate adjudicatory process provided in GST...

Refund Can’t Be Denied If Excess Tax Paid Was Not Recovered, Even If Shown As Expenditure In Balance Sheet: CESTAT

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that if tax has been excess paid...

RBI Allows Banks To Hike ATM Fees: New Charges Effective From May 2025

In a move that directly impacts everyday banking for millions, the Reserve Bank of India (RBI) has revised the charges...

India Imposes 20% Export Duty on All Parboiled and Certain Milled Rice Varieties Starting May 1, 2025

In a significant move aimed at regulating rice exports and ensuring domestic food security, the Ministry of Finance has...

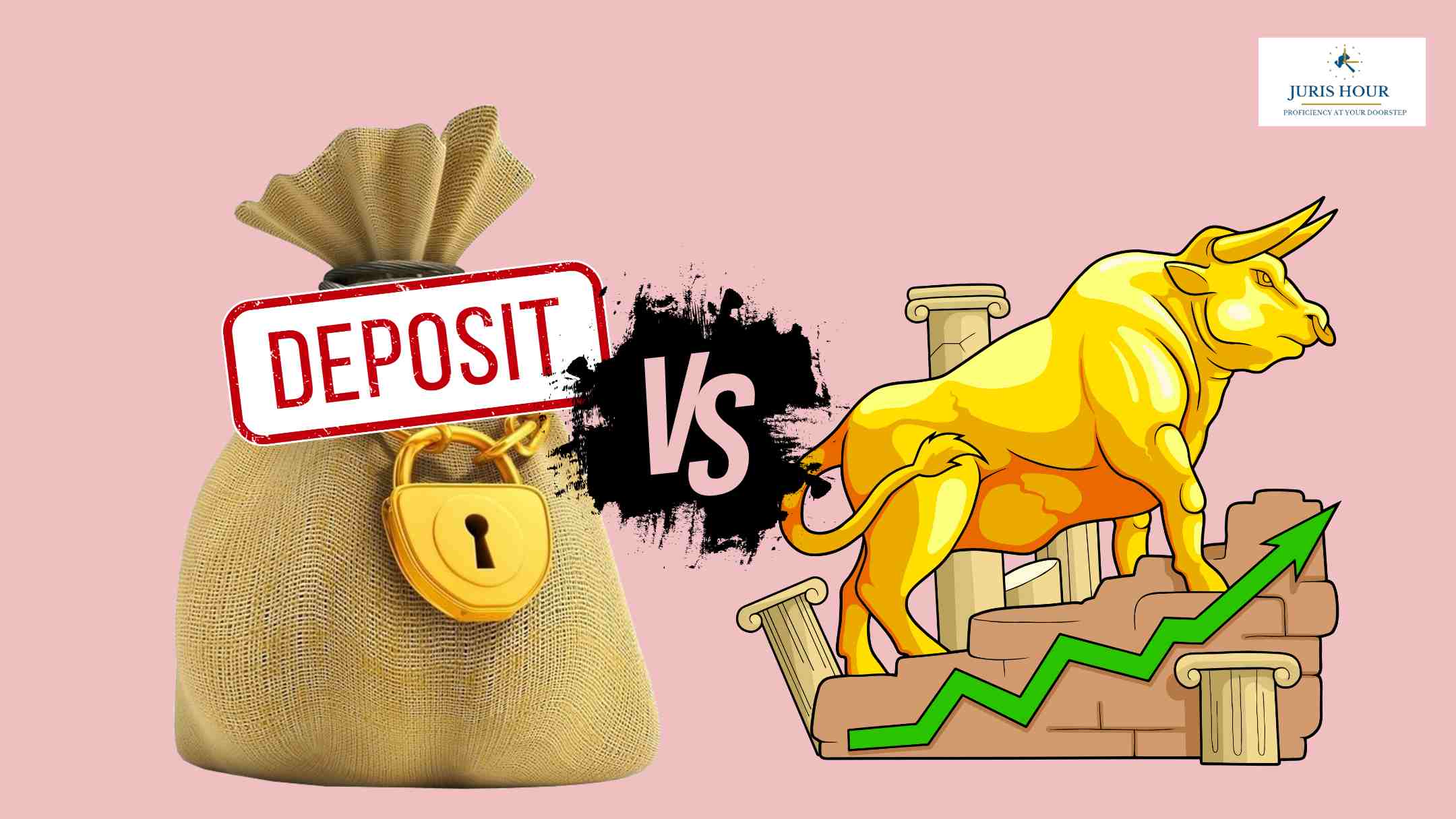

FD vs Stocks in India: Where Should You Invest?

In India, Fixed Deposits (FDs) and Stocks represent two contrasting forms of investment. FDs are traditionally...

Govt. Eases Import Duties on Select Rice Varieties Effective May 1, 2025

In a move aimed at facilitating trade and supporting consumer interests, the Ministry of Finance has issued Notification...

Advocate Exempted From Service Tax On Income From His Legal Service: Orissa High Court

The Orissa High Court has held that advocates are exempted from service tax on income from his legal service. The...

What Happens to Gold Seized by Indian Customs? Here's the Truth

In light of rising gold smuggling cases, the Central Board of Indirect Taxes and Customs (CBIC) has clarified what...

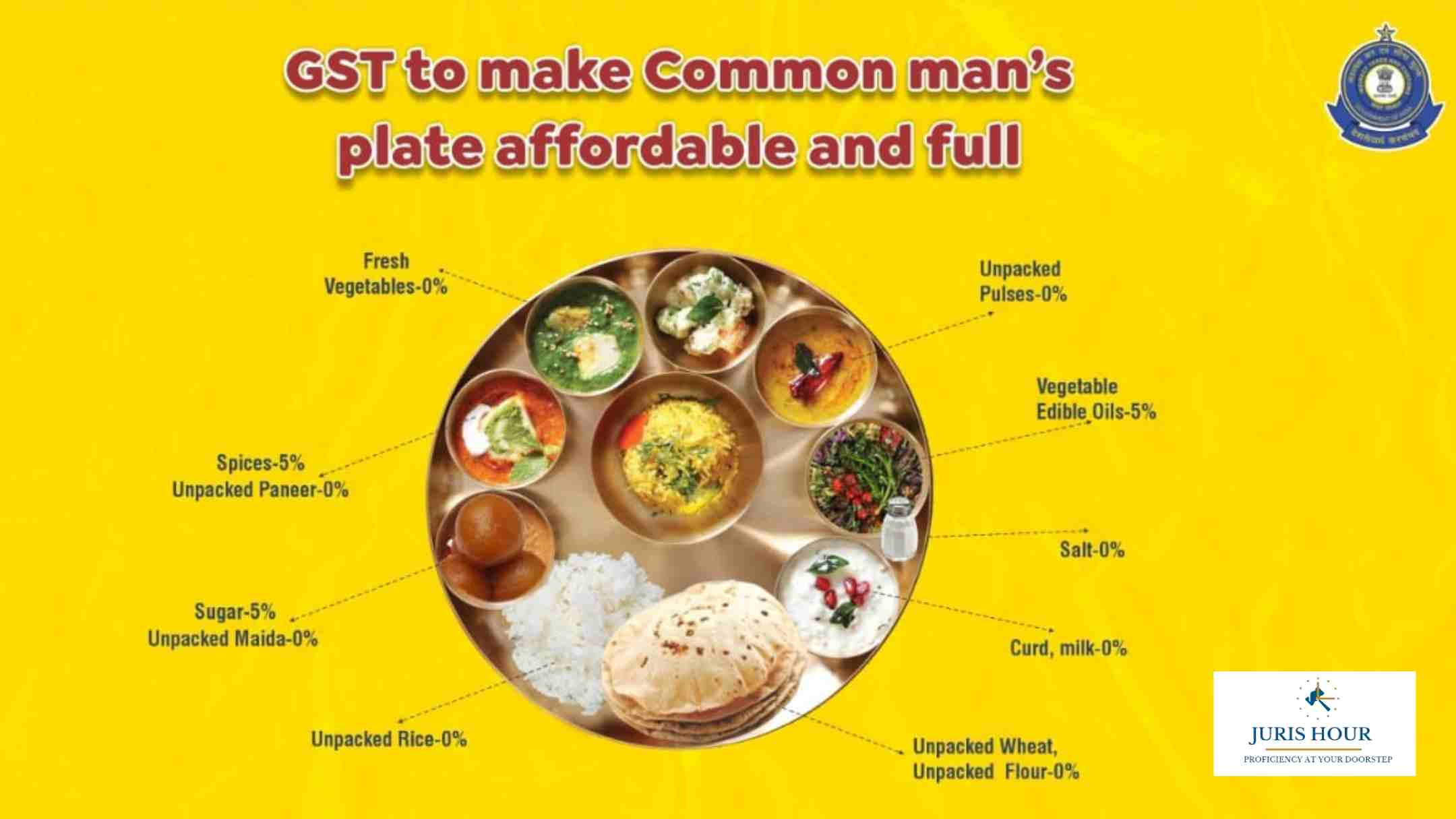

GST Reforms Aim to Keep the Common Man's Plate Affordable and Full

In a move aimed at curbing food inflation and ensuring nutritional security for all, the Central Board of Indirect Taxes...

GSTAT Non-Constitution: Madhya Pradesh High Court Stays Recovery Subject To Payment of Rs. 3.53 Crores

The Madhya Pradesh High Court has stayed the recovery of interest and penalty amount subject to payment of...