Customs Duty | Engineering And Technical Service Fees Includible In Assessable Value Of Imported Goods: Supreme Court

The Supreme Court has held that the engineering and technical service fees/charges were includable in the assessable...

CBI Books Four CGST Officials for Illegal Search and Attempt to Extort Private Firm in Nagpur

In a significant crackdown on corruption within government ranks, the Central Bureau of Investigation (CBI) has...

A Proud Moment: Advocate Rakesh Chitkara Joins JurisHour as Mentor and Editor-in-Chief

It is a moment of immense pride and celebration for the legal and policy community as Advocate Rakesh Chitkara, a...

5% VAT On Sale Of Liquid Carbon Dioxide: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that 5% Value Added Tax (VAT) on sale of liquid carbon dioxide. The bench of...

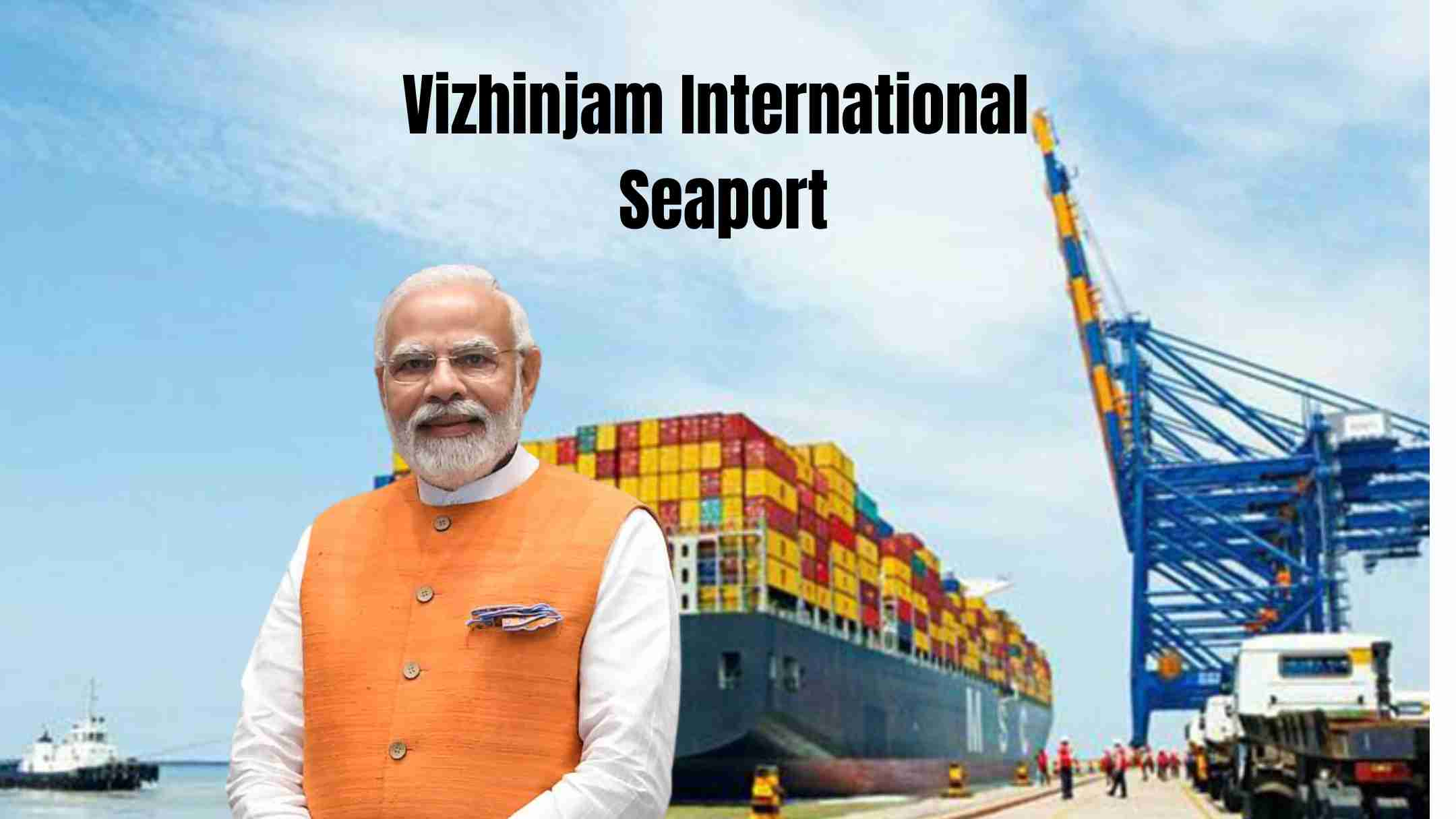

PM Modi Inaugurates Vizhinjam International Seaport, Placing Kerala on the Global Maritime Map

Prime Minister Narendra Modi on Thursday inaugurated the Vizhinjam International Seaport, India’s first deep-water...

Non-Issuance Of Notice Caused No Prejudice As Case Clearly Spelt Out In Audit Report: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that non-issuance of notice caused no prejudice as the case clearly spelt out...

Is India and Pakistan Financially Ready For A War In 2025?

The enduring tensions between India and Pakistan have not only led to significant human and geopolitical costs but have...

Arvind Shrivastava Takes Charge As Revenue Secretary

Arvind Shrivastava, took charge as the Secretary, Department of Revenue, Ministry of Finance, today (01/05/2025). The...

Bombay High Court Deletes Bail Condition Requiring Surrender of Passport in Rs. 5 Crore Gold Smuggling Case

The Bombay High Court has deleted the bail condition requiring surrender of passport in Rs. 5 Crore gold smuggling case....

Delhi High Court Refuses To Waive 10% Pre-Deposit For Filing GST Appeal

The Delhi High Court has refused to waive 10% pre-deposit for filing Goods and Service Tax (GST) Appeal. The bench of...

Gross And Net GST revenue collections For April 2025

The Gross Goods and Services Tax (GST) collections for April 2025 reached a record Rs. 2,36,716 crore, marking a robust...

GSTN to Mandate Phase-3 HSN Code Reporting and Table 13 Compliance from May 2025

In a continued effort to enhance transparency and streamline tax reporting, the Goods and Services Tax Network (GSTN)...