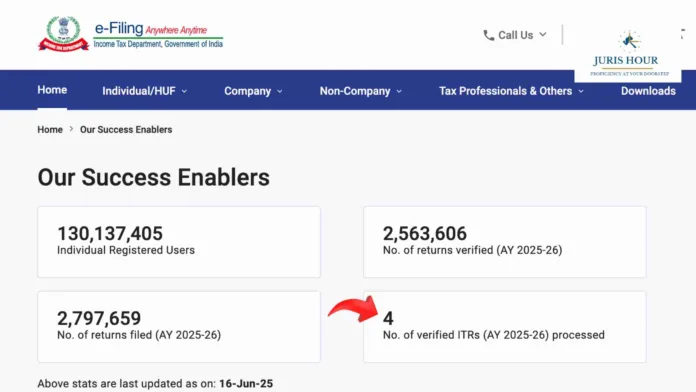

As of June 13, 2025, more than 20 lakh Income Tax Returns (ITRs) have already been filed for the Assessment Year 2025–26. However, what has surprised many is that only 4 of these returns have been processed so far.

This wide gap between returns filed and returns processed has sparked concern and confusion among taxpayers. The slow pace has raised questions about the efficiency of the current system.

A Suggestion: Share the Names of These 4 ‘Lucky’ Taxpayers

Several tax professionals and citizens have proposed that the government should consider disclosing the names (with necessary privacy safeguards) of the only 4 taxpayers whose ITRs have been processed so far. This would allow others to learn from their approach — whether it was the timing of their filing, the method used, or the simplicity of their return.

What Could Be Learned?

- Did they use pre-filled ITR forms from the portal?

- Was their return straightforward, without deductions or disputes?

- Did they file using a trusted tax professional or platform?

- Were their bank details and Aadhaar-PAN linkage already verified?

Questions for the Government

- Is there a technical bottleneck in return processing?

- Are these 4 returns part of a pilot batch for early testing?

- When can the broader base of taxpayers expect processing to pick up?

Transparency Builds Trust

At a time when millions have already submitted their returns and the July 31 deadline is approaching, there is a growing demand for clarity and transparency from the Income Tax Department. A brief, anonymized case summary of the first few processed ITRs could offer valuable insight and boost taxpayer confidence.

Some citizens are even remarking,

“Forget the refund — we just want to know how those 4 got processed so fast.”

The current pace of ITR processing raises valid concerns about the department’s readiness for the high volume of returns. With filing activity increasing daily, timely updates and system efficiency will be key to maintaining public trust in the return processing system.

Read More: Tax Evasion Leads To Arrest, Knowing The Law Leads To Your Rights