Cricket lovers shelling out thousands for IPL tickets might be surprised to learn they are paying more than 70% in taxes. A recent social media discussion has brought this issue to light, sparking outrage among fans.

IPL Ticket Tax Breakdown: Fans Express Outrage

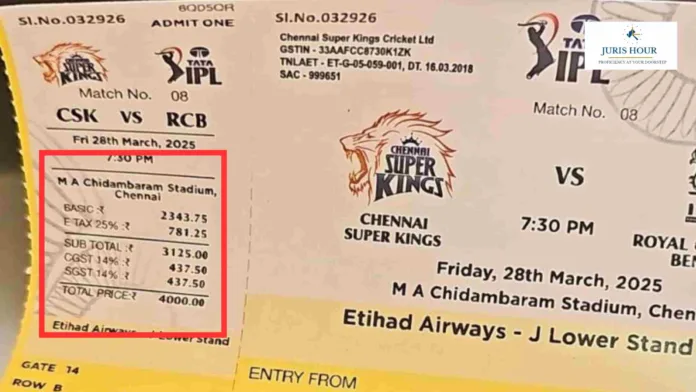

A viral social media post has ignited a debate on the hefty taxation imposed on Indian Premier League (IPL) match tickets. A cricket fan, Ravi Handa, pointed out that a ticket priced at Rs 2,343 was sold for Rs 4,000 after multiple tax additions, amounting to a tax burden exceeding 70%.

The ticket, for a match between Chennai Super Kings (CSK) and Royal Challengers Bengaluru (RCB) at MA Chidambaram Stadium in Chennai, included the following taxes:

- 25% Entertainment Tax (levied by the Tamil Nadu government)

- 14% Central Goods and Services Tax (CGST)

- 14% State Goods and Services Tax (SGST)

This revelation has led many to criticize the “tax-on-tax” policy applied to IPL tickets, with users calling it unfair to fans who are willing to spend on live cricket experiences.

BCCI’s Tax-Free Status Sparks Debate

Adding fuel to the controversy, the Board of Control for Cricket in India (BCCI) enjoys a zero per cent tax exemption on IPL earnings, as it is registered as a “charitable organization” under Section 12A of the Income Tax Act. The Income Tax Appellate Tribunal (ITAT) upheld this status in 2021, ruling that the BCCI’s objective of promoting cricket remains intact, despite the IPL’s commercial nature.

In contrast, IPL players face tax deductions at source (TDS):

- Indian players: 10% TDS

- Foreign players: 20% TDS

Social Media Reactions: Fans Criticize ‘Tax-on-Tax’ System

Outraged by the high taxation, cricket fans took to social media to express their frustration:

- “25% Entertainment Tax has been there for 14 years in Tamil Nadu. It’s time for a change.”

- “This is a masterclass in India’s ‘Tax-on-Tax’ policy playbook. You’re not just paying to watch the match; you’re funding a policy loophole.”

- “Entertainment Tax was supposed to be merged into GST, but Tamil Nadu is still imposing it separately. That’s why we are paying tax on tax.”

Understanding the ‘Tax-on-Tax’ Issue

A detailed analysis by a Reddit user explains that while Entertainment Tax was largely subsumed under GST in 2017, local bodies retained the right to impose additional entertainment taxes. As per Section 15(2)(a) of the CGST Act, 2017, the value of supply includes any additional taxes levied under any law except GST. This results in a cascading tax effect, where GST is applied on an already taxed amount.

Final Thoughts: Is IPL a Luxury or a Necessity?

While cricket remains a passion for millions of Indians, the high taxation on IPL tickets has raised concerns about affordability. Some argue that attending IPL matches is a luxury, justifying the high taxes, while others believe that the government should reconsider the policy to make live sports events more accessible.

With the ongoing debate, will policymakers address the issue, or will fans continue to pay premium prices for their love of the game? Only time will tell.

Read More: Non-Grant Of Duty Drawback To Vedanta: Delhi High Court Directs CBIC to Pass Reasoned Order