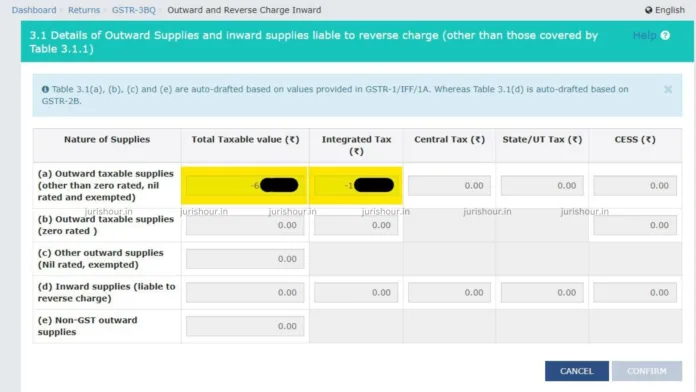

In a major development related to the GST portal, it is now allowing the negative values in outward supply Table 3.1 of GSTR 3B.

It will resolve the issue of Negative Liability in cases where there were only sale return transactions in a particular month and no sale transactions.

Regular taxpayers, including those opting for the QRMP scheme, must file form GSTR-3B return. It is a monthly summary return but the frequency can be once a quarter for the QRMP taxpayers.

Table 3.1 was added as a part of the modification to GSTR-3B vide the CGST Notification 14/2022 dated 5th July 2022. Further, the taxpayer must avoid duplication and should not report such e-commerce sales value or taxes thereof in previous Table 3.1.

As per Section 9(5) of CGST Act, Electronic Commerce Operator (ECO) is required to pay tax on supply of services such as Passenger Transport Service, Accommodation services, Housekeeping Services & Restaurant Services, if such services are supplied through ECO.

A new Table 3.1.1 is being added as per Notification No. 14/2022 – Central Taxdated 05th July, 2022in GSTR-3B where both ECOs and registered persons can report supplies made under Section 9(5) as mentioned below.

Read More: BREAKING | No GST On Leasehold Rights: Bombay High Court