In a significant compliance-related update, the Goods and Services Tax Network (GSTN) has rolled out a new enhancement in the Invoice Management System (IMS), aimed at simplifying the process of identifying cases where tax liability must be added back in GSTR-3B.

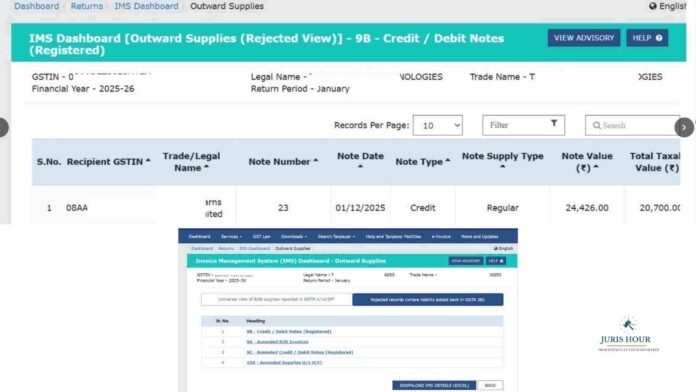

Under the latest update, a separate tab has been introduced in the Outward IMS section to specifically display Rejected Credit Notes and related entries where corresponding liability is required to be reversed or added back in the monthly return.

Until now, taxpayers and professionals had to manually scrutinize all IMS entries to detect such cases, making the reconciliation process time-consuming and prone to oversight. The absence of a segregated view often resulted in additional effort during return filing and reconciliation.

With the introduction of this dedicated tab, the system will automatically categorize and display relevant rejected credit notes, allowing businesses to easily track instances where output tax liability needs to be adjusted in GSTR-3B.