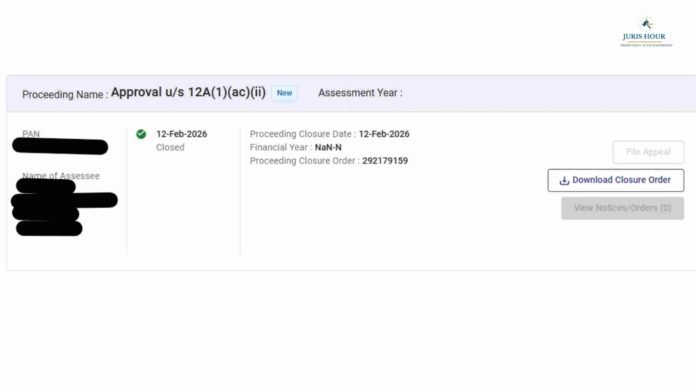

The Income Tax Department has started issuing orders, notices, and closure communications in respect of pending renewal applications filed under Section 12A and Section 80G of the Income-tax Act, 1961. The communications are being issued by the jurisdictional Commissioner of Income Tax (Exemptions) [CIT(E)] through the e-filing portal.

Applicants who have sought renewal of registration under Section 12A (relating to charitable or religious trusts and institutions) and approval under Section 80G (for donor tax benefits) are receiving approvals as well as rejection orders through the portal. In several cases, notices seeking additional documentation, clarifications, and explanations are also being issued before final disposal of the applications.

Orders and Notices Being Uploaded on Portal

The Department has activated electronic communication for such proceedings. Closure orders are being uploaded under the “e-Proceedings” and “Application Status” sections of the Income Tax portal. Applicants are also being notified via their registered email IDs.

Members and stakeholders are advised to regularly monitor:

- Registered email ID (including Spam/Junk folders)

- “e-Proceedings” tab on the Income Tax Portal

- Application Status page for approval or rejection orders

Failure to respond to notices within the stipulated time may adversely affect the outcome of renewal applications.

Statutory Deadline: 31 March 2026

As per statutory timelines, 31 March 2026 is the last date for passing orders on such renewal applications. With the deadline approaching, applicants may receive portal communications or notices at any time prior to the cut-off date.

Tax professionals advise trusts, societies, and non-profit organizations to remain vigilant and ensure timely compliance with any queries raised by the Department to avoid rejection or delays in renewal.

The developments signal that the Department is moving to clear the backlog of renewal applications well before the statutory deadline, making proactive monitoring and prompt response critical for applicants.

Read More: Telecom Spectrum Can’t Be Restructured Under IBC: Supreme Court