In a landmark advancement for India’s digital justice ecosystem, the Goods and Services Tax Appellate Tribunal (GSTAT) has issued its first fully paperless judgment in a second appeal, signalling a transformative shift in how tax disputes may be adjudicated in the future.

The milestone reflects the growing integration of technology into quasi-judicial bodies and reinforces the government’s broader push toward transparent, efficient, and accessible dispute resolution mechanisms.

Seamless Digital Proceedings

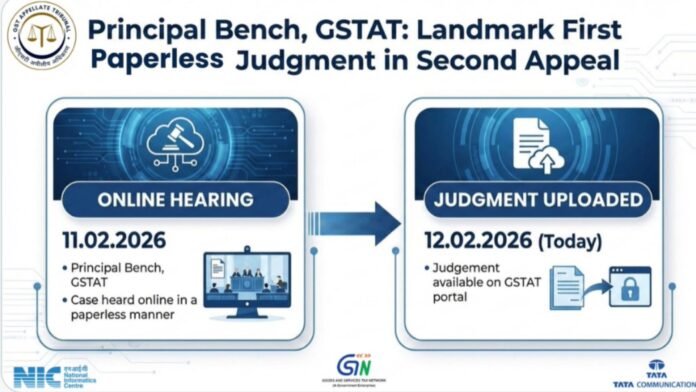

The case was heard through an entirely online format on February 11, 2026, before the Principal Bench of GSTAT. Conducted without physical filings or courtroom appearances, the proceedings relied exclusively on electronic submissions and virtual arguments.

Remarkably, the tribunal uploaded the judgment to its official portal the very next day—February 12, 2026—demonstrating the speed that digital adjudication can offer when supported by robust technological infrastructure.

The development was announced by the GST Network (GSTN), which described the achievement as a “new chapter in tax adjudication,” highlighting the role of technology in enhancing procedural efficiency and transparency.

Technology Backbone Powers Reform

Behind the successful rollout of the paperless process is a collaboration between major technology and infrastructure providers. Infosys, the managed service provider for GSTN, has been instrumental in building and maintaining the platform that enables secure digital filings and case management.

The initiative also drew support from the National Informatics Centre (NIC), which provides government-focused digital solutions, and Tata Communications, known for its secure network services. Together, these institutions ensured stable connectivity, data protection, and seamless virtual interaction throughout the proceedings.

Implications for Tax Litigation

Experts believe the successful execution of a paperless second appeal could redefine the litigation landscape under the Goods and Services Tax regime. Traditionally, tax disputes have been document-heavy and procedurally complex, often leading to delays.

A digital framework offers several advantages:

- Faster disposal of cases through reduced administrative bottlenecks

- Lower compliance costs for businesses by eliminating travel and printing expenses

- Greater accessibility for taxpayers and legal representatives across geographies

- Improved transparency through real-time document tracking and electronic records

Such efficiency gains are expected to strengthen taxpayer confidence while supporting India’s ease-of-doing-business objectives.

Part of a Larger Judicial Modernisation Drive

The move aligns with nationwide efforts to modernise courts and tribunals through technology-driven reforms. Paperless hearings not only reduce environmental impact but also help institutions manage growing caseloads without proportionally increasing physical infrastructure.

Legal analysts note that if replicated across regional benches, the model could significantly reduce pendency in GST appeals—one of the critical challenges facing the indirect tax framework since its rollout.