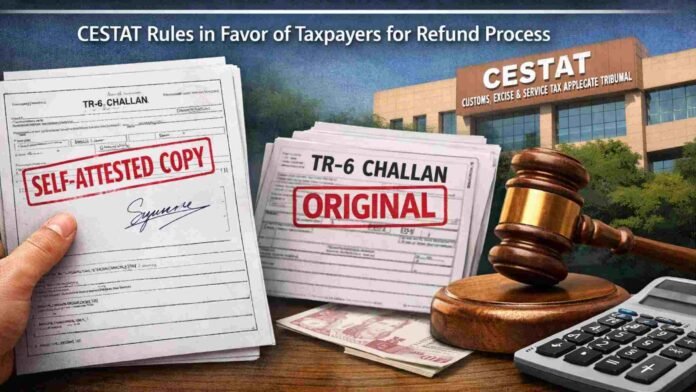

The Ahmedabad Bench Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has held that an assessee is entitled to refund of the entire amount deposited during litigation once the demand itself is set aside, and refund cannot be denied merely due to non-availability of original TR-6 challans or old bank records. The bench of Dr….

HomeIndirect TaxesSelf-Attested Copies Sufficient for Refund; Dept. Can’t Insist on Original TR-6 Challans:...

Self-Attested Copies Sufficient for Refund; Dept. Can’t Insist on Original TR-6 Challans: CESTAT

0

194

Mariya Paliwalahttps://www.jurishour.in/

Mariya is the Senior Editor at Juris Hour. She has 5+ years of experience on covering tax litigation stories from the Supreme Court, High Courts and various tribunals including CESTAT, ITAT, NCLAT, NCLT, etc. Mariya graduated from MLSU Law College, Udaipur (Raj.) with B.A.LL.B. and also holds an LL.M. She started as a freelance tax reporter in the leading online legal news companies like LiveLaw & Taxscan.