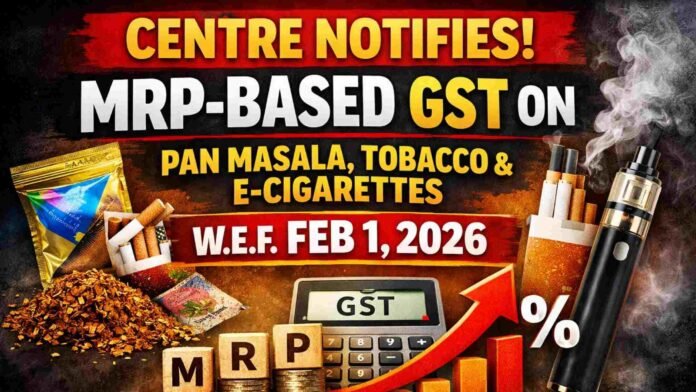

The Central Government has notified the Central Goods and Services Tax (Fifth Amendment) Rules, 2025, introducing a new Rule 31D that mandates Maximum Retail Price (MRP) based Goods and Service Tax (GST) valuation of specified goods namely Pan Masala, Tobacco, and E-Cigarette Products with effect from 1 February, 2026.

The amendment, issued vide Notification No. 20/2025–Central Tax dated 31 December 2025, will come into force from 1 February 2026, following recommendations of the GST Council.

Under the newly inserted Rule 31D, the value of supply of certain notified goods shall be deemed to be the retail sale price declared on the package, minus applicable GST, notwithstanding any other valuation provisions in the CGST Rules, 2017.

The rule applies to the following categories of goods:

- Pan masala

- Unmanufactured tobacco (excluding tobacco leaves)

- Cigarettes, cigars, cheroots and cigarillos

- Other manufactured tobacco products (excluding biris)

- Products containing tobacco or reconstituted tobacco for inhalation without combustion

- Nicotine substitute products such as e-cigarettes and vaping products

These goods have historically been flagged by tax authorities for undervaluation and revenue leakage, particularly where supply chains involve multiple intermediaries.

Clear Formula Prescribed for Tax Computation

Rule 31D provides a specific formula for computing the tax component embedded in the RSP:

Tax Amount = (Retail Sale Price × applicable tax rate) ÷ (100 + total applicable tax rate)

The notification clarifies that “applicable tax” includes CGST, SGST, UTGST or IGST, as the case may be.

Wider Definition of Retail Sale Price

The amendment adopts a broad and anti-evasion-oriented definition of Retail Sale Price, stating that:

- RSP means the maximum price declared on the package, inclusive of all taxes, cesses and duties.

- Where multiple RSPs are printed, the highest RSP shall be deemed to be the retail sale price.

- Any increase in RSP at any stage—before, during or after supply—shall be considered the valid RSP.

- Different RSPs declared for different regions shall apply area-wise for valuation purposes.

This mirrors valuation principles earlier used under excise law and reflects a shift towards price-linked taxation for sin goods.

Relaxation from Rule 86B for Certain Dealers

The notification also amends Rule 86B, which restricts use of input tax credit beyond 99% of tax liability in specified cases.

A new clause (f) has been inserted in the first proviso to Rule 86B, exempting registered persons other than manufacturers from the restriction only in respect of goods covered under Rule 31D, provided tax has already been paid by the supplier on the basis of RSP.

This relief is expected to ease working capital pressures for downstream traders and distributors dealing in notified goods.

Notification Details

Notification No. CBIC-20001/2/2025-GST

Date: 31/12/2025

Read More: Bribery Case | CBI Arrests 1 IRS-C&IT Officer, 2 Superintendents of CGST Jhansi And Advocate