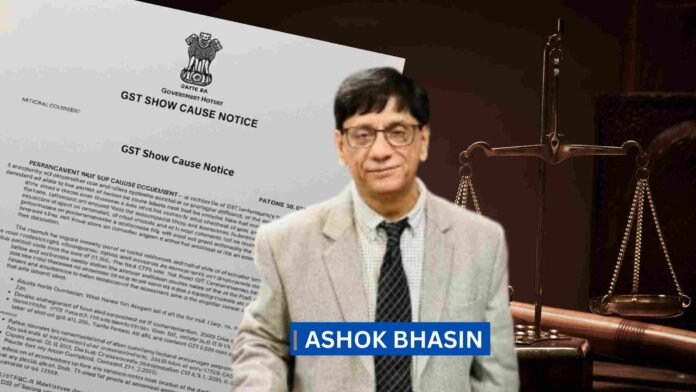

The article “When Law Speaks One Language and Courts Another: A Case of Limited Application of Mind in GST SCNs”is authored by Mr. Ashok Bhasin. A graduate of Hindu College, Delhi University, he joined the Customs and Central Excise Department in 1976 and later completed his M.A. in Philosophy and LL.B. from Delhi University. In 1996, he received the President of India Award for his distinguished service. After leaving the department the same year, he began practising as an advocate and is currently a member of both the Delhi High Court Bar Association and the Supreme Court Bar Association. Mr. Bhasin is also an accomplished author. Gulnora is his fifth novel, following the well-received thrillers It Was Not Gold, Stupid Lawyer, Chapter 31, and Her Secret.

GST is a great law and its interpretations are amazing. But somehow, I am confused. Couple of high courts’ judgments have come, where it has been held that the show cause notices issued under Section 73/74 are to be issued financial year-wise and a consolidate SCN covering multiple financial years is not legally allowed under the aforesaid sections. The bunching of show cause notice is held to be impermissible. In one particular judgement, if I correctly remember, the consolidate show cause notice issued for multiple years were quashed and the department was asked to issue separate show cause notices for each financial year.

I got confused and I tried to reason, by different permutations and combinations as to how separate show cause notice for a financial year is beneficial to a tax payer and as to how the consolidated show cause notice for multiple year is beneficial to the department. I failed to find any reason practically and legally. These judgements were based on the premises that the limitation period of three years/five years as envisaged in Section 73 (10)/74(10) is to be taken from the due date from furnishing of annual returns for the financial year to which the tax is not paid. This is being interpreted in a way by Hon’ble High Courts that a separate show cause notice for one financial year has to issued.

I was preparing myself to write something on these judgements and I kept thinking of writing a piece. Alas!!!! Before I could write, the Ministry issued the clarification on the issue on 16.09.2025 countering such judgements and justifying that the proper officer is duly empowered to issue a consolidated show cause notice subject to statuary framework. It also clarified that clubbing of several financial years in one show cause notice does not compromise the overall timelines given in Section 73(10) and Section 74(10) of the CGST Act, 2017. In the said clarification, there is a reference of judgement passed by Hon’ble Supreme Court (AIR 1966 SC 1350 in case of State of J&K Vs. Caltex India Limited).

The GST policy wing have to search back and had been able to find this judgement of 1966 covering a composite period from January 1955 to May 1959. Good work done by the GST policy wing — clap-clap for them.

I thought may be the issue will rest. However, I received GST law times where another judgement of Hon’ble Madras High Court in the case of R.A. And Co. This judgement is dated 21.07.2025. This is prior to the issuance of ministry circular. It finds no mention in the clarification. This judgement has gone into detail discussing not only the limitation angle but also Sub-Section (3) & (4) referring to a term“Statement” to further emphasis the term “Tax Period”. There is a reference of Hon’ble Supreme Court’s judgment in the above-mentioned judgment but still after discussion, it was held that the issuance of composite show cause notice covering multiple financial years frustrates the limitation scheme and, in a nutshell, it was held that no show cause notice can be clubbed and issued for more than one financial year since the same is impermissible in law.

What shall be taken as a correct position?? No one knows. GST policy wing is singing its own tune and the High Courts are singing a different tune.

Sad! The GST Law is great and its interpretations are amazing.

Can we call it limited application of mind on limitation?