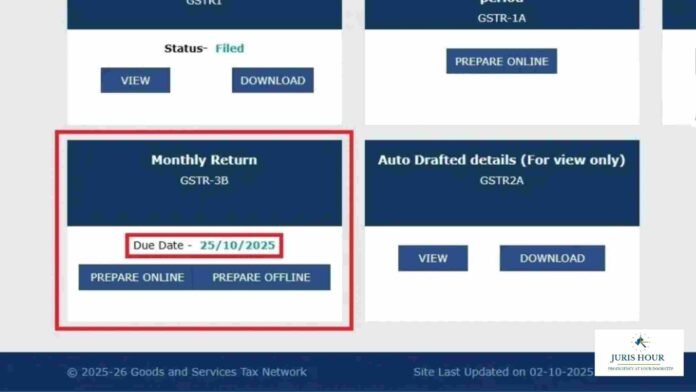

In a surprising development, the Goods and Services Tax (GST) portal on October 17, 2025, began displaying a new due date of October 25, 2025, for filing GSTR-3B, the monthly summary return filed by registered taxpayers under the GST regime. The updated date appeared under the section titled “Monthly Return – GSTR-3B” on the official portal, sparking speculation and confusion across the taxpayer community.

Usual Deadline: 20th of Every Month

Under normal circumstances, the GSTR-3B return — which captures details of outward supplies, input tax credits (ITC), and the net tax payable — must be filed by the 20th of each month for most taxpayers. Timely filing of GSTR-3B is critical, as it determines the flow of tax credit and helps maintain compliance under the GST law.

No Official Circular or Notification Issued

While the change in due date is visible on the GST portal, no official circular or notification confirming the extension has been issued by the Central Board of Indirect Taxes and Customs (CBIC) or the GST Council so far. The absence of an official communication has left businesses, tax professionals, and chartered accountants uncertain about whether the new deadline is a genuine extension or merely a technical update or system error.

Read More: Bombay High Court Dismisses JSW Techno’s Writ Petition Against Raigad Commissionerate; Imposes Costs