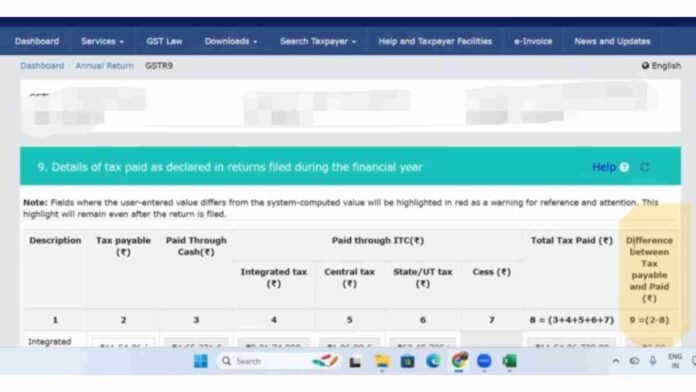

In a significant move aimed at improving the accuracy and transparency of annual return filings, the Goods and Services Tax Network (GSTN) has introduced a key change in Table 9 of GSTR-9 — the annual return form filed by registered taxpayers.

What Has Changed?

Earlier, taxpayers faced frequent reconciliation issues when the actual tax liability exceeded the amount reported and paid through GSTR-1 (Outward Supplies) and GSTR-3B (Monthly Return). In such cases, the differential tax was paid through Form DRC-03.

However, these additional DRC-03 payments were not automatically reflected in GSTR-9, often leading to mismatches between the tax payable and tax paid figures, causing confusion during audits and scrutiny.

The New Addition: Column 9 in Table 9

To address this long-standing concern, a new column (Column 9) has been introduced in Table 9 of the GSTR-9 form. This new field will capture the difference between tax payable and tax paid — including any payments made through DRC-03 — providing a comprehensive view of total tax discharge during the financial year.

GSTR-9

Form GSTR-9 is an annual return to be filed once for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers. The taxpayers are required to furnish details of purchases, sales, input tax credit or refund claimed or demand created etc.

Read More: Assembled Vehicles: CESTAT Quashes Rs. 155 Crore Customs Duty Demand Against Coal India, GMMCO