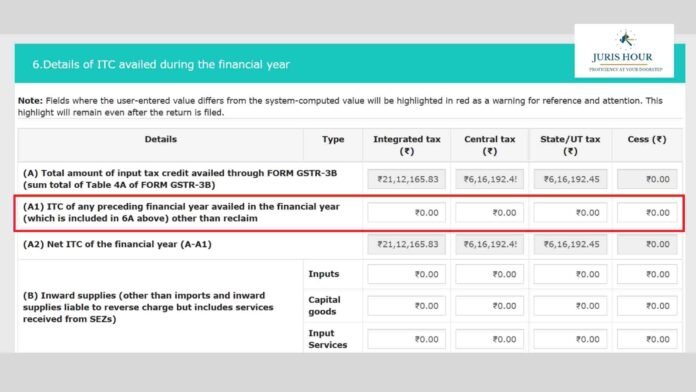

The government has introduced an important change in Table 6 of GSTR-9 for the financial year 2024–25.

Taxpayers can now report Input Tax Credit (ITC) pertaining to the previous financial year but claimed in the current year’s GSTR-3B in a specific and distinct column.

Until now, taxpayers faced ambiguity while reporting such ITC adjustments. The GSTR-9 format did not contain a separate field to declare ITC of the preceding financial year that was availed in the subsequent year’s returns. As a result, many taxpayers had to report such ITC either as a negative figure in Table 6B or under the “Others” category (Table 6M) — leading to non-uniform reporting across different filers and potential mismatches during reconciliation and audits.

For FY 2024–25, Table 6 has been revised to include a dedicated column for ITC of the previous financial year claimed in the current year’s GSTR-3B.