The Directorate General of Trade Remedies (DGTR), under the Ministry of Commerce and Industry, has initiated an anti-dumping investigation into the imports of Ethambutol Hydrochloride, a key drug used in the treatment of tuberculosis (TB), originating from China and Thailand.

The probe was launched following an application filed by Lupin Limited, which alleged that the import of the drug from these countries at unfairly low prices has caused material injury to the domestic industry.

Product Under Investigation

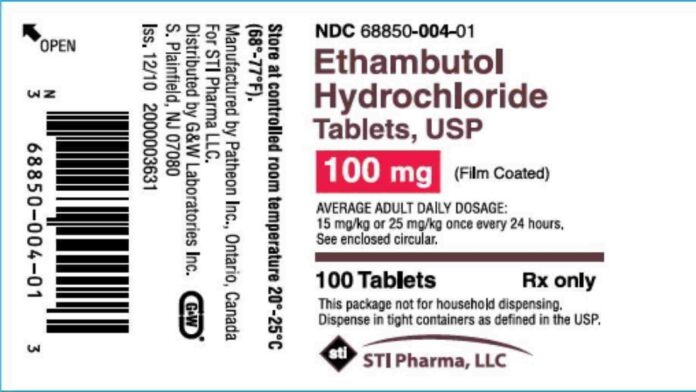

Ethambutol Hydrochloride, a bacteriostatic drug with the molecular formula C10H24N2O2·2HCl, is widely used in the treatment of pulmonary TB. Typically, it is prescribed in combination with other anti-TB medicines to prevent drug resistance.

The drug, imported under Chapter 29, heading 2905 (sub-heading 29051490) of the Customs Tariff Act, is produced domestically but allegedly faces price undercutting due to cheaper imports from China and Thailand.

Domestic Industry Standing

- Applicant: Lupin Limited

- Other Indian producers: Cadila Pharmaceuticals Ltd. and Themis Medicare Ltd.

- Status:

- Cadila is also an importer of the drug.

- Themis Medicare has reportedly stopped manufacturing it.

- Hence, Lupin currently accounts for 100% of the eligible domestic production.

The DGTR noted that Lupin neither imports the drug from the subject countries nor is related to exporters, fulfilling the criteria to qualify as “domestic industry” under anti-dumping rules.

Prima Facie Evidence of Dumping

- Dumping Margin: Preliminary analysis revealed that the export price from China and Thailand is significantly lower than the normal value, resulting in dumping margins well above the permissible threshold.

- Injury Claims:

- Price undercutting of domestic products.

- Suppression of price increases.

- Forced sales at non-remunerative prices to retain market share.

- Decline in profitability during the injury period (2021–22 to 2024–25).

DGTR concluded that there exists sufficient evidence of dumping and consequent injury to justify the initiation of a formal investigation.

Investigation Details

- Period of Investigation (POI): April 1, 2024 – March 31, 2025.

- Injury Examination Period: 2021–22, 2022–23, 2023–24, and the POI.

- Procedure: Interested parties, including exporters, importers, and governments of China and Thailand, have been notified to submit relevant information within 30 days.

Failure to cooperate may lead to the DGTR recording its findings based on “facts available” and recommending appropriate duties to the Central Government.

Notification Details

Case No. AD(OI)- 22/2025

Date: 23/09/2025

Read More: ED Charges Raj Kundra, Shilpa Shetty in ₹60 Crore Bitcoin Fraud Case