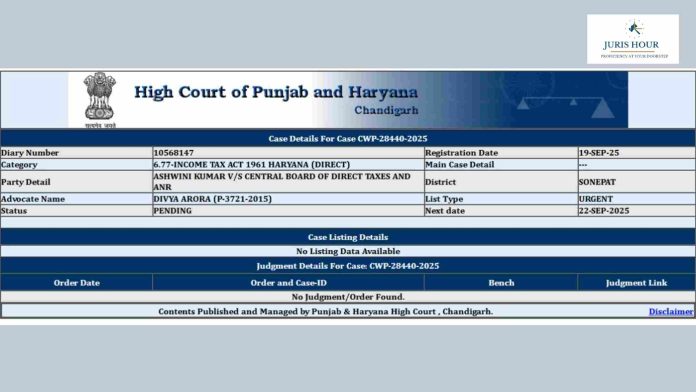

The writ petition has been filed before the Punjab & Haryana High Court regarding the Tax Audit due date extension for the Financial Year 2024-25. (ASHWINI KUMAR V/S CENTRAL BOARD OF DIRECT TAXES AND ANR)

The matter will be listed for hearing on 22/09/2025.

The petition was filed as the ITR filing process was severely hampered this season due to recurring technical failures on the portal.

The Finance Ministry was approached to identify the root causes and implement immediate solutions, but no relief was granted.

In a formal representation, the association listed several key problems faced by taxpayers and chartered accountants in the run-up to the September 16 filing deadline:

- System instability – Frequent crashes, slow loading, and server errors, particularly during peak filing days.

- Faulty pre-filled data and tools – Inaccuracies in pre-filled information, malfunctioning utilities, and calculation mismatches that forced manual corrections, undermining the digital filing system.

- Ineffective grievance support – Helpdesks failing to respond adequately to taxpayer queries, often providing generic or irrelevant answers.

- Administrative inaction – Despite repeated complaints from professional bodies, the technical flaws have remained unresolved.

- Impact on compliance – Delays caused by the dysfunctional portal led to missed deadlines, penalties, and interest charges, putting undue pressure on compliant taxpayers.

Demands of the Tax Body

The Amritsar association has urged the Finance Ministry to take the following steps immediately:

- Independent technical audit – A third-party review of the portal’s operations, with findings made public.

- Stronger grievance redressal – A high-level task force, including representatives of professional associations, to address complaints within strict timelines.

- Deadline extensions – Statutory deadlines for return filing and related compliances should be extended until the portal functions reliably.

- Accountability – Responsibility should be fixed on developers and administrators for persistent failures of the system.