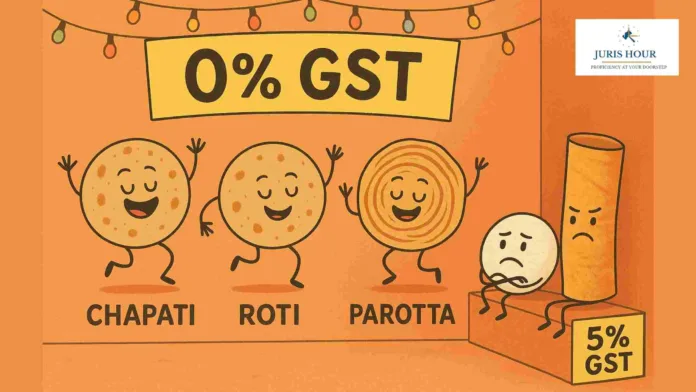

A fresh debate has emerged on social media after questions were raised on why idli and dosa batter continues to attract Goods and Services Tax (GST), while items like chapati, roti, and parotta are exempted from the levy.

Dr. Ganesh, a user on platform X, questioned the tax disparity, tagging Finance Minister Nirmala Sitharaman’s official account: “Why is idli dosa batter still subject to 5% GST, while chapati, roti, and parottas are made nil tax?” His post quickly gained traction, sparking a flurry of responses and highlighting perceived regional imbalances in the GST regime

The issue has taken on a cultural tone, with some users pointing out that food staples commonly consumed in North India enjoy a nil tax rate, whereas South Indian staples such as idli and dosa mixes face GST. Some even alleged that revenue generated from the South is disproportionately “sucked to the North”

Amid the debate, a clarification resurfaced from the Central Board of Indirect Taxes and Customs (CBIC). According to officials, idli/dosa batter is classified under HSN 2106 – “Food preparations not elsewhere specified or included” – and is taxed at 5% GST, not 18% as some users mistakenly claimed. The distinction lies in how products are categorized: ready-to-eat (RTE) items attract nil GST, while ready-to-cook preparations such as batters and mixes fall under the 5% slab

The controversy comes at a time when food inflation and taxation continue to be politically sensitive issues. While social media has amplified the debate with cultural undertones, the Finance Ministry has yet to issue a fresh response to these concerns.

For now, consumers in the South remain vocal about what they see as an “uneven tax burden” on their staple foods, keeping the GST debate alive both online and offline.