This Article pertaining to “GST Rate Cuts Mean Nothing If Industries Pocket the Benefit” is written by Dr Monish Bhalla. He is a distinguished author, legal expert, and former officer of India’s Narcotics Control Bureau (NCB). With 37 years in public life, Dr. Bhalla has been a key figure in drug law enforcement and indirect taxation in India. His expertise in the fields of GST, Customs, and narcotics control has made him a leading voice in legal reforms and national policy. He is also a well-known columnist and has authored several books on GST, drug trafficking, and legal matters.

“Watchdog Put to Sleep: A Free Pass to Profiteers Under GST”

The GST Council’s latest decision to slash rates across a wide range of goods and services—from daily essentials like soaps and shampoos to tractors, tyres, medical kits, and insurance—has been projected as a landmark reform. It is pitched as a people-friendly measure, a bold attempt to ease the cost burden on households, strengthen farmers, and stimulate consumption at a time when the economy needs momentum.

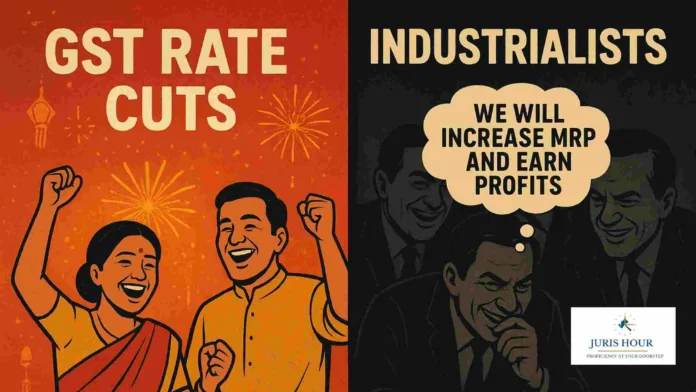

On the surface, it reads like a Diwali gift for the nation. But dig a little deeper, and the story isn’t so celebratory. Because what really matters is not what the Council announces in Delhi, but what the consumer pays at the kirana store, the restaurant counter, or a shopping mall or the housing project office. And there lies the catch.

“A TAX CUT THAT NEVER LOWERS THE PRICE IS NOT REFORM—IT IS DECEPTION.”

When GST was introduced in July 2017, lawmakers foresaw this problem. They knew industries might quietly pocket benefits instead of passing them on. That is why Section 171 of the CGST Act was drafted in strong terms. It states that any reduction in GST rate or any benefit from input tax credit must be passed on to the recipient by way of a commensurate reduction in prices. The Law was Crystal Clear The intent was unambiguous, pass the tax relief to the end consumer .

“Tax relief is public money meant for the people, not private margins meant for profiteers.”

To enforce this mandate, the Anti-Profiteering Authority was created. Its job was to ensure that GST rate cuts were not swallowed up by industries but reached consumers in the form of lighter bills.

And yet, history tells us that industries have often failed this test. In the FMCG sector, MRPs on soaps, shampoos, packaged foods, and detergents frequently remained unchanged despite GST reductions. Consumers never saw the relief. In the restaurant sector, many establishments increased menu prices precisely when GST rates were cut from 18% to 5%. The reduction was neutralized before it could reach the diner’s pocket. In real estate, homebuyers discovered that builders had not passed on benefits of reduced GST or input tax credits, forcing regulatory interventions and orders to return crores. These were not accidental lapses. They were systemic attempts to retain what rightfully belonged to the citizens.

“When relief is announced at the top but blocked at the bottom, it is not reform—it is betrayal by the Industry”

Initially, the Anti-Profiteering Authority did crack down on several industries, ordering restitution of crores of rupees. But over time, delays, litigation, and a lack of speed diluted its bite. In 2022, the Competition Commission of India (CCI) was tasked with handling these cases. In 2024, the law was further amended, allowing the government to notify a cut-off date beyond which no fresh anti-profiteering requests could be entertained.And then came the most drastic step. Vide Notification No. 19/2024 – Central Tax, dated 30th September 2024, it was declared that from 1st April 2025, no fresh cases of profiteering will be admitted under Section 171.

This decision is nothing short of alarming. If profiteering flourished when the watchdog was alive, what will happen once the gates are closed to new complaints?

“The very watchdog created to ensure GST cuts and input-tax credits reach the people put to sleep. It is nothing less than a free pass to profiteers.”

The GST Council’s intent may be noble. But the absence of strong enforcement risks making reforms hollow. A reduction in GST on paper is just that—paper. Unless MRPs are reduced, the consumer sees no change.

In fact, a tax cut that never appears in household budgets is worse than no cut at all, because it creates a dangerous illusion. It tells citizens relief has been delivered, when in reality nothing has changed.

This disconnect erodes public trust. Families struggling with inflation expect tangible savings in their grocery bills, healthcare costs, and housing expenses. If industries absorb those benefits, faith in both government policy and market fairness collapses.

If India wants its “Next-Gen GST” to succeed, it must back announcements with proper plans in place to ensure no industry pocket these benefits and following steps may prove to be important and essential:

- Automatic Price-Tracking: Industries should be mandated to submit pre- and post-GST cut price data within seven days of any notification. A mismatch should trigger immediate scrutiny.

- Time-Bound MRP Updates: Legal Metrology rules must be amended to enforce MRP re-stickering or digital price adjustments within 15 days. No excuses, no delays.

- Penalties That Hurt: The current penalty—10% of profiteered amount—is pocket change for large corporations. For repeat offenders, licences should be suspended, GST registrations cancelled, and government contracts barred.

- Direct Consumer Restitution: Wherever possible, restitution must be credited directly to consumers, not just deposited into central funds. Citizens must feel the benefit in their wallets.

- Transparency & Accountability: Publish quarterly reports naming sectors and entities caught profiteering. Public exposure is often more effective than financial penalties.

- Sector-Specific Playbooks: Clear rules should be framed for sectors like FMCG, restaurants, real estate, and automobiles to prevent ambiguity in calculating commensurate price reduction.

GST reform is not just a fiscal exercise—it is a promise between the State and the citizen. The Council may announce cuts, but if industries block the flow of relief, the promise is broken. At stake is more than just economics. It is trust. Citizens must believe that when the government announces relief, it will reach them. Without that belief, reform loses legitimacy.

At stake is more than just economics. It is trust.

The GST Council has played its part by cutting rates. But the battle is only half-won. Enforcement must ensure that profiteering does not swallow the savings. Otherwise, the consumer will continue paying yesterday’s prices under today’s tax.India cannot afford hollow reforms. A tax cut without enforcement is no relief—it is betrayal dressed as policy.

The government must act now, before the sunset of anti-profiteering becomes the dawn of unchecked profiteering. Because in the end, reform is not about announcements in Delhi; it is about bills in the hands of ordinary Indians.

Read More: GST Rate Cuts Misleading, Benefit Tilted Towards Corporates: CPI(M) Leader Rajesh Singhvi