As the deadline for filing Income Tax Returns (ITRs) draws closer, taxpayers and professionals are raising red flags over persistent glitches in the Income Tax portal. With just 15 days left and nearly 3 crore ITRs yet to be filed, essential services like AIS, TIS, and Form 26AS remain non-functional, while many users report that One-Time Passwords (OTPs) are not being delivered.

Chartered Accountant Sumit Sharma took to social media platform X (formerly Twitter) to highlight the challenges faced by taxpayers, raising questions about the government’s claims of “ease of doing business.”

In his post, Sharma tagged the official handle of the Income Tax Department and pointed out that nearly three crore ITRs are yet to be filed, but key services remain non-functional. According to him, the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) portals are not working, the Form 26AS facility is down, and many users are reporting issues with One-Time Password (OTP) delivery, which is essential for authentication.

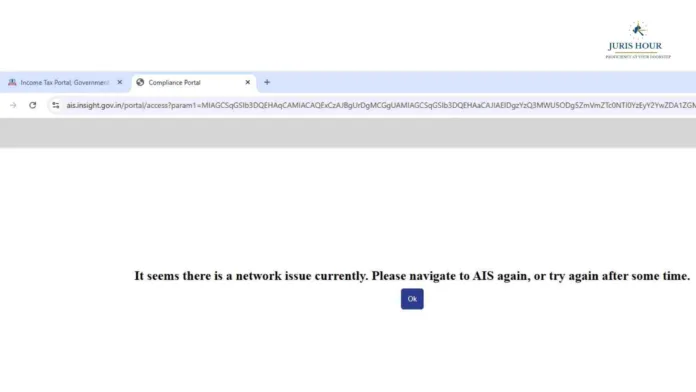

Sharma shared a screenshot showing the AIS portal displaying a message: “It seems there is a network issue currently. Please navigate to AIS again, or try again after some time.”

These technical glitches have caused widespread frustration among taxpayers and professionals, particularly at a time when filing activity is at its peak. Industry experts warn that if the issues are not resolved quickly, a last-minute rush could overwhelm the system further, potentially delaying compliance.

Many professionals argue that repeated downtime of the income tax portal has become a recurring issue despite multiple upgrades and maintenance exercises in recent years. They fear this could discourage voluntary compliance and increase litigation over delayed filings.

The Income Tax Department is yet to release an official statement addressing these concerns. Meanwhile, taxpayers and professionals are urging authorities to extend the deadline or provide immediate fixes to the portal.

As the filing deadline approaches, the situation highlights the ongoing struggle between digitisation efforts and the practical realities of system preparedness — raising a critical question: Is this truly “ease of doing business”?