A glaring instance of administrative inconsistency in GST registration has come to light as CA Perumalla Venkata Suneel, a tax practitioner, took to social media to highlight the ordeal he faced due to the automatic approval and subsequent suspension of his GST registration application.

In a post dated July 31, Suneel explained how his application for GST registration was initially auto-approved due to inaction by the tax officers. However, once officials reviewed the application at a later date, the registration was promptly suspended, and he was issued a Show Cause Notice demanding submission of physical documents at the office for verification. Despite complying with the request, the suspension had still not been revoked at the time of his post.

“Applied for GST registration, officers are too busy, so registration got auto-approved, then officers woke up and suspended, asked to submit all docs at office, submitted but still not revoked. Why auto approved, why suspended,” Suneel questioned in a tweet tagging @cbic_india and @Infosys_GSTN.

Show Cause Notice Raises Eyebrows

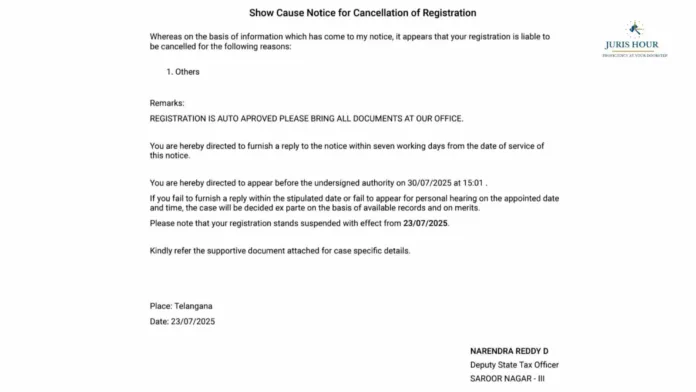

The Show Cause Notice issued on July 23, 2025, cited “Others” as the reason for possible cancellation and included a rather curt remark:

“REGISTRATION IS AUTO APPROVED. PLEASE BRING ALL DOCUMENTS AT OUR OFFICE.”

The notice further instructed Suneel to appear before the designated tax authority on July 30 and warned that failure to reply or attend the hearing could result in ex-parte proceedings. The registration was suspended effective July 23, 2025.

The Larger Issue: Auto-Approval & Administrative Delays

Under the GST framework, if tax authorities fail to process registration applications within a specific timeframe—typically three working days—the system automatically approves the registration. This safeguard is intended to prevent bureaucratic delays from stalling legitimate businesses. However, the same safeguard has become a double-edged sword when followed by belated scrutiny and suspension.

Suneel’s case underscores the contradiction in this mechanism: a registration that was automatically approved due to departmental inaction is now being challenged by the very system that failed to act within time.