A serious technical glitch on the Goods and Services Tax (GST) portal has once again come under scrutiny, as a taxpayer attempting to respond to a DRC-01A notice for the Financial Year 2021–22 has been rendered unable to upload their reply due to an unexpected system response indicating that the taxpayer had “opted for waiver scheme.”

The matter came to light through a post shared by Chartered Accountant Nikhil Bhandari on social media platform X (formerly Twitter), tagging key authorities including the Central Board of Indirect Taxes and Customs (CBIC), GST Council, Finance Minister Nirmala Sitharaman, and Infosys, the GST Network (GSTN) service provider.

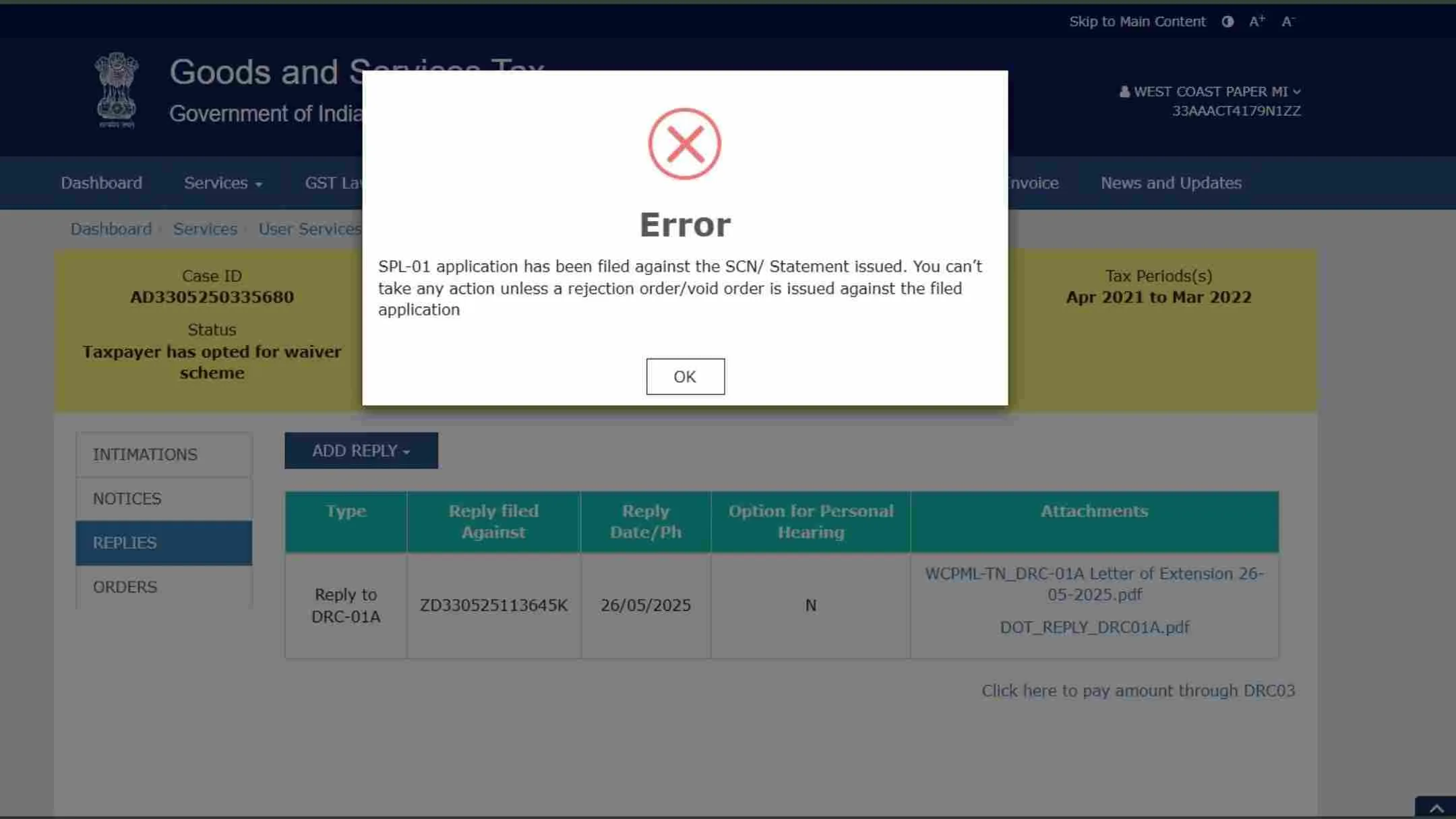

According to the post, the taxpayer had initially received a DRC-01A notice and had formally sought additional time to file a reply. However, when they later attempted to upload their reply through the official GST portal, an error message appeared stating:

“SPL-01 application has been filed against the issued demand raised. You are not allowed to file reply for the issued SCN as you have opted for waiver scheme.”

This unexpected error effectively blocked the taxpayer from submitting their legitimate response, even though no explicit action was taken to opt for any waiver scheme.

The incident raises important concerns regarding transparency and functionality within the GST compliance framework. Not only does it point to a potential system misfire or misclassification, but it also highlights the difficulties taxpayers continue to face in navigating procedural compliance—especially when technical issues interfere with legal rights of representation.

Experts are now urging the GSTN and CBIC to investigate and resolve the glitch immediately. There is also a call for a more user-friendly and accountable support system to address technical grievances faced by assessees.

This isn’t the first time Infosys and the GST portal have come under fire for operational inefficiencies. The persistence of such issues years after implementation of the GST regime continues to frustrate both tax professionals and businesses.

Until an official clarification or rectification is issued, the concerned taxpayer remains in a state of procedural limbo. Stakeholders are watching closely to see how authorities respond to this ongoing problem.