A recent ASMT-10 notice issued by the GST department has triggered concern among tax professionals, raising questions about proportionality and administrative efficiency in compliance enforcement.

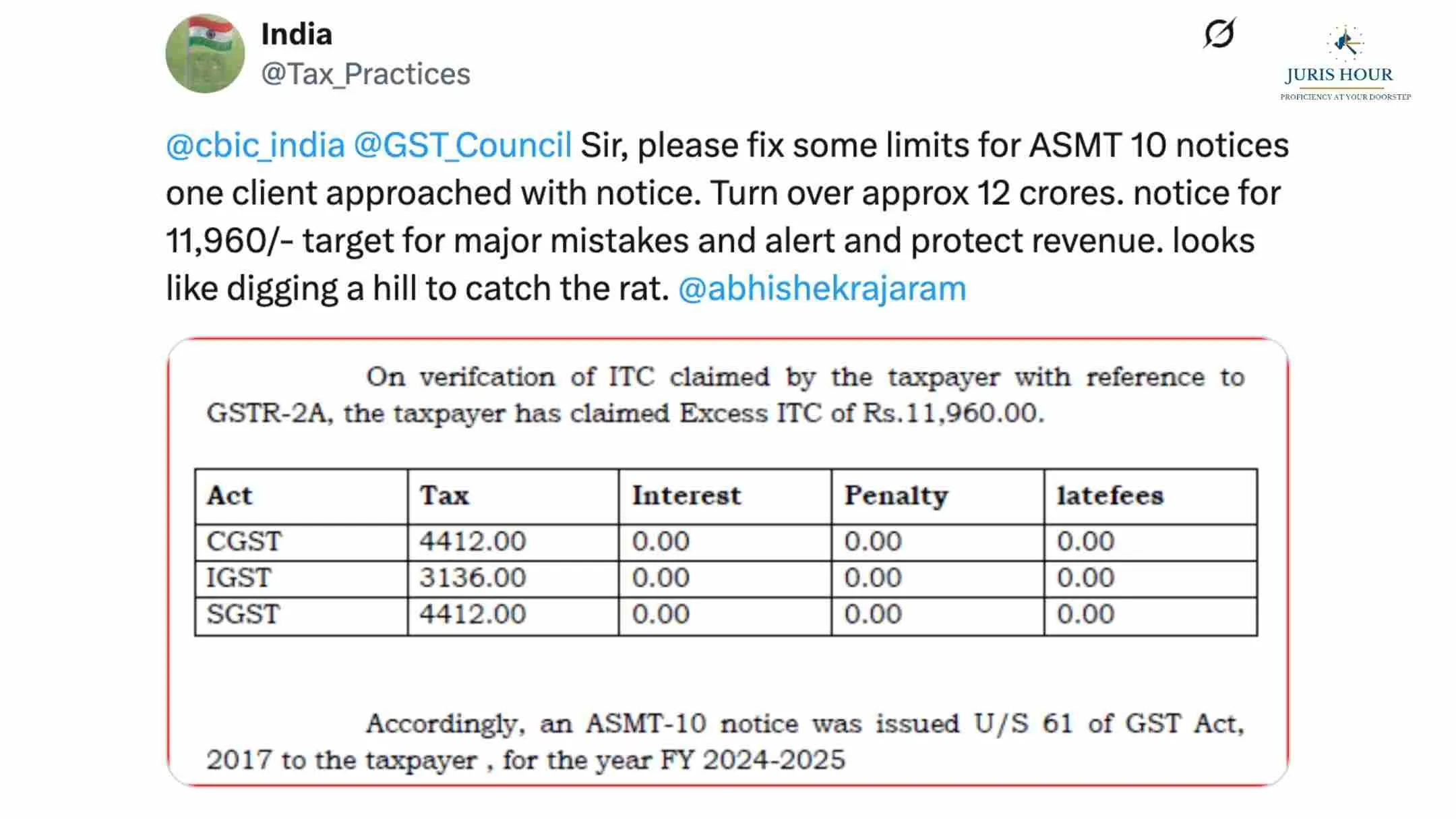

A Twitter post by a user under the handle “@Tax_Practices” highlighted the case of a taxpayer with an annual turnover of approximately ₹12 crore who was issued a notice under Section 61 of the CGST Act, 2017 for an excess Input Tax Credit (ITC) claim of just ₹11,960. The ITC in question—claimed under CGST, SGST, and IGST—was found in excess based on GSTR-2A reconciliation, but with no associated interest, penalty, or late fee.

According to the notice:

- CGST Excess ITC: ₹4,412

- IGST Excess ITC: ₹3,136

- SGST Excess ITC: ₹4,412

- Total Excess ITC: ₹11,960

Professionals argue that issuing a detailed scrutiny notice (ASMT-10) for such a small discrepancy, especially in high-turnover cases, could undermine trust and divert resources from more serious tax evasion cases. The post compared the move to “digging a hill to catch a rat,” urging the Central Board of Indirect Taxes and Customs (CBIC) and the GST Council to introduce minimum thresholds or de minimis limits for issuing scrutiny notices.

“This is not about ignoring compliance but about prioritising enforcement where it matters,” the post read, tagging senior CBIC officials and policy experts.

Call for Administrative Reform

Under Section 61, ASMT-10 notices are issued when discrepancies are noticed during the scrutiny of returns. While the provision allows officers to seek clarification on any mismatch or anomaly, tax practitioners say it needs rationalisation.

“Every small mismatch shouldn’t lead to a formal notice unless it indicates a pattern of evasion. With automation and AI now part of GSTN’s backend, alerts should be calibrated based on risk profiles,” said a senior indirect tax consultant.

Policy Implications

The incident has reignited the debate on compliance burden, especially for MSMEs and honest taxpayers. Many are urging the GST Council to:

- Introduce monetary thresholds for issuing ASMT-10 notices.

- Leverage data analytics to focus on high-risk cases.

- Avoid unnecessary litigation over minor discrepancies.

As GST enters its eighth year of implementation, experts argue that fine-tuning procedural thresholds will go a long way in making the system both robust and taxpayer-friendly.