You Searched For "Tax"

Central GST Officers Detect Rs 1.95 Trillion Tax Evasion in...

The Central Goods and Services Tax (CGST) officers have uncovered tax evasion cases worth a staggering Rs 1.95 trillion...

Income Tax Principal Commissioner Can Cancel 12A Registration Without...

The Kerala High Court has held that the income tax principal commissioner can cancel registration under Section 12A of...

Mismatch In Goods Description and Missing E-Way Bill Establishes Tax...

The Allahabad High Court has held that the mismatch in goods description and missing e-way bill establishes tax evasion...

GST Dept. Sent Summons Of Wrong Email Address: Delhi High Court...

The Delhi High Court has quashed the order on the grounds that the GST department sent summons of wrong email address...

Whether Summons by CGST Dept. Can Be Issued Even If State GST Dept....

The Supreme Court has reserved judgement on the issue whether summons by the Central GST department can be issued even...

PCIT Invites Application For Empanelment As Senior And Junior Standing...

The Principal Commissioner of Income Tax (Judicial) (PCIT) has issued the notice for engagement of senior and junior...

Bombay High Court Bail Plea: Alleged Rs. 8,500 Crore GST Scammer...

The alleged Rs. 8500 crores gst scammer files bail application in Bombay High Court against the arrest made by the...

Direct Tax Weekly Flashback: 2 March to 8 March 2025

Direct Tax Weekly Flashback for the period 2 March to 8 March 2025. Table of ContentsDelhi High CourtTwo-Tier...

Andhra Pradesh High Court Quashes GST Assessment Order Citing...

The Andhra Pradesh High Court has quashed the GST assessment order citing non-mention of Director Identification Number...

Rejection of Application For Compounding Of Offence Under Income Tax...

The Bombay High Court has directed the Chief Commissioner to reconsider the application for compounding of offence under...

GST Dept. Issues Interest Recovery Notices For Delayed Outward Supply...

The Goods and Services Tax (GST) Department has started issuing notices for the recovery of interest on delayed...

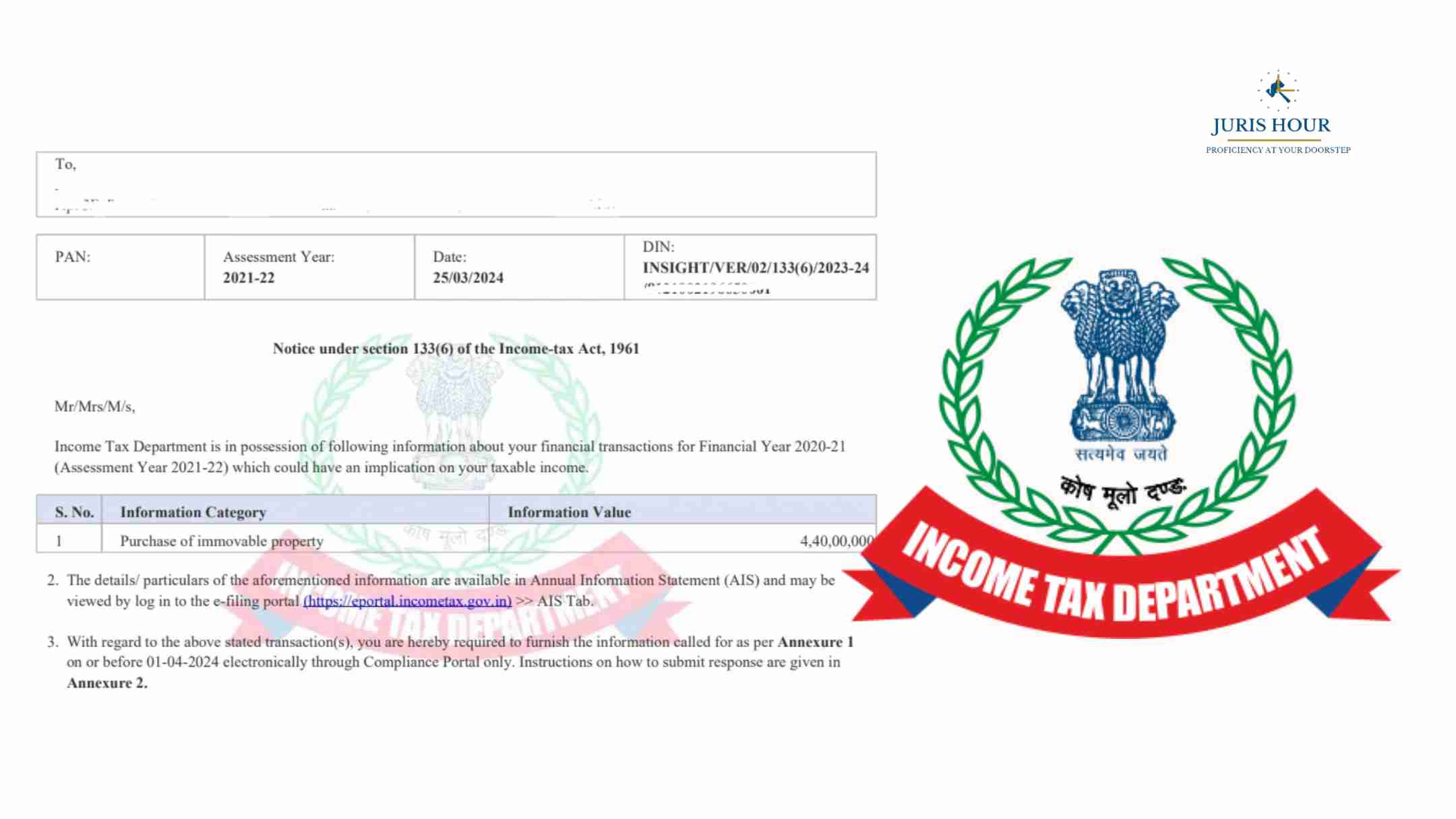

Income-Tax Dept. Issues Notices Over Mismatch in High-Value Expenses...

The Income-Tax (I-T) department has recently intensified scrutiny on high-income individuals whose bank withdrawals...