You Searched For "Income Tax"

Income Tax Principal Commissioner Can Cancel 12A Registration Without...

The Kerala High Court has held that the income tax principal commissioner can cancel registration under Section 12A of...

Income Tax | Disputed Question Of Fact In Respect Of Proper Notice...

The Kerala High Court has held that the disputed question of fact in respect of proper notice under Income Tax Act...

Bombay High Court Orders RBI to Accept Old Demonetised Notes Seized in...

The Bombay High Court has directed the Reserve Bank of India (RBI) to accept demonetised currency notes from a group of...

PCIT Invites Application For Empanelment As Senior And Junior Standing...

The Principal Commissioner of Income Tax (Judicial) (PCIT) has issued the notice for engagement of senior and junior...

Direct Tax Weekly Flashback: 2 March to 8 March 2025

Direct Tax Weekly Flashback for the period 2 March to 8 March 2025. Table of ContentsDelhi High CourtTwo-Tier...

Section 87A Rebate Confusion: Taxpayers With Capital Gains Might Get...

A major controversy has erupted over the applicability of the Section 87A rebate in India’s income tax law, particularly...

Rejection of Application For Compounding Of Offence Under Income Tax...

The Bombay High Court has directed the Chief Commissioner to reconsider the application for compounding of offence under...

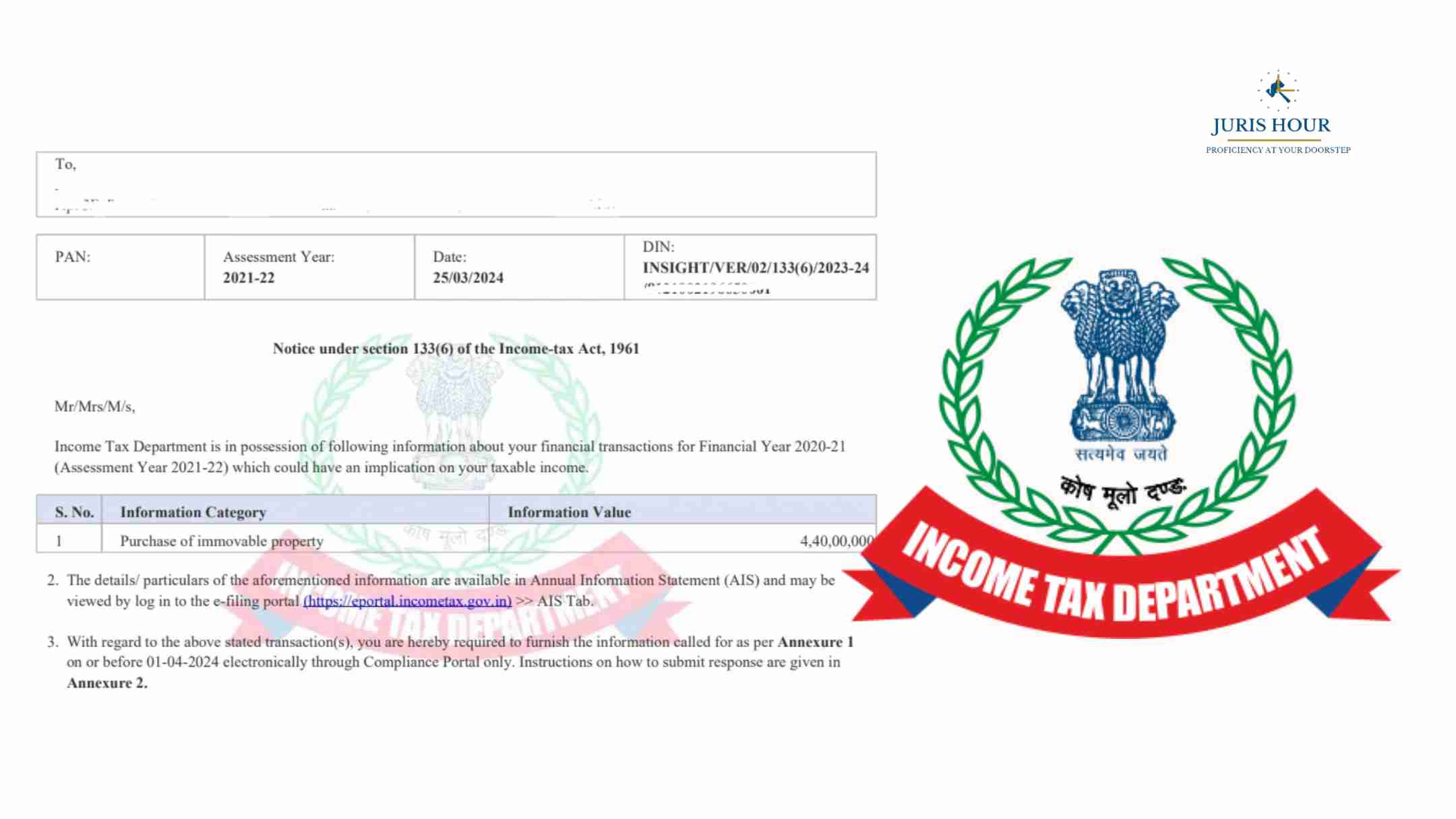

Income-Tax Dept. Issues Notices Over Mismatch in High-Value Expenses...

The Income-Tax (I-T) department has recently intensified scrutiny on high-income individuals whose bank withdrawals...

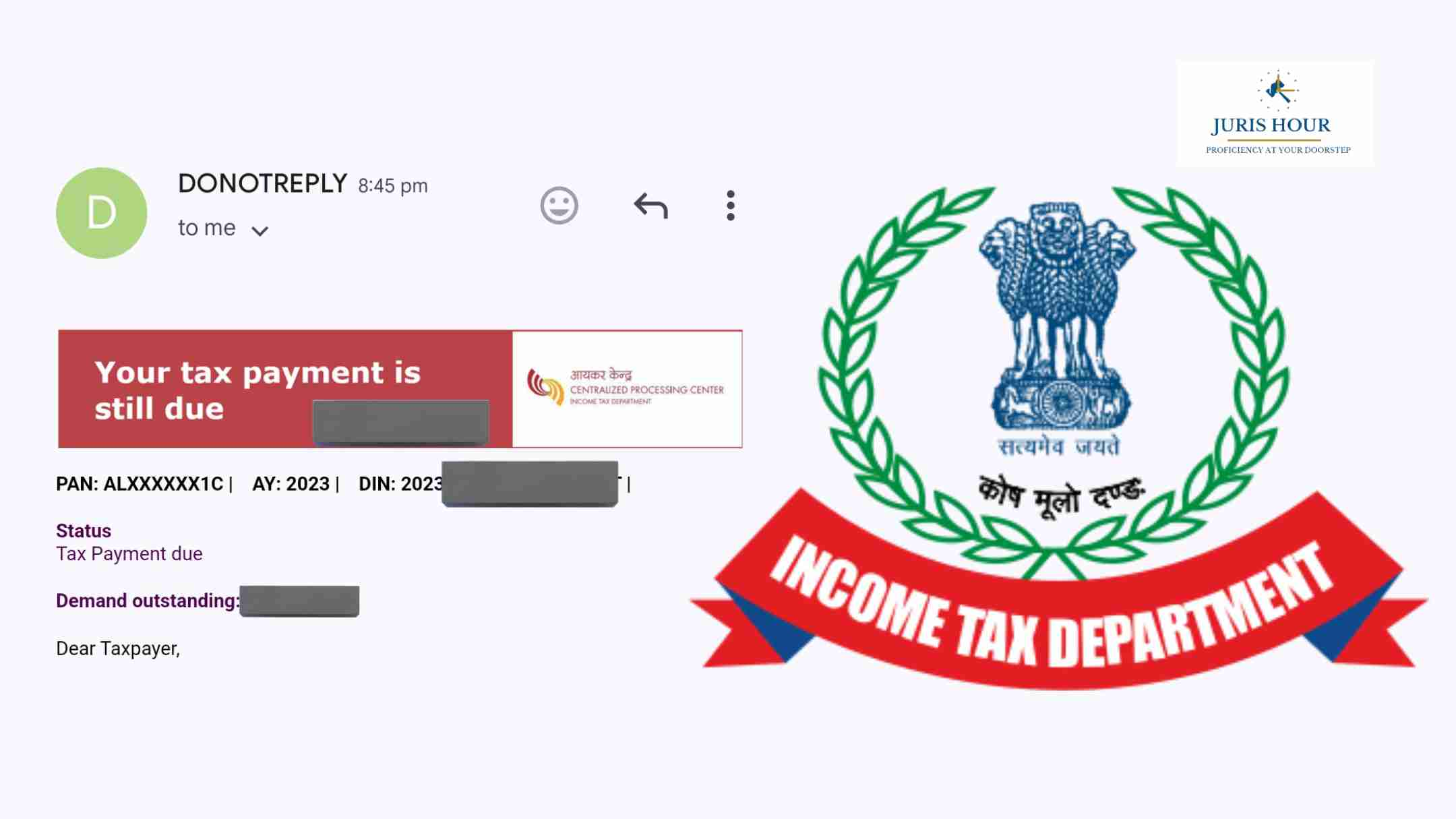

Many Taxpayers Receive Emails on Outstanding Income Tax Dues: Here’s...

Several taxpayers across India have reported receiving official emails from the Income Tax Department notifying them...

Income Tax Dept. Can’t Indefinitely Attach Properties Without Steps...

The Delhi High Court while ruling in favour of Fasttrack has held that it is impermissible for the department to keep...

Bombay High Court Imposes Cost Of Rs. 10K For Assessee’s Failure To...

The Bombay High Court has imposed the cost of Rs. 10K on Assessee, who failed to inform the Assessing Officer (AO) about...

RaOne Tax Case: ITAT Quashes Reassessment Against Shah Rukh Khan

The Mumbai Bench of Income tax Appellate Tribunal (ITAT) has quashes income tax reassessment against Shah Rukh Khan for...