You Searched For "GST"

Uber’s Cash-Only Auto Rides: The GST Confusion Explained!

Uber has switched to a cash-only model for auto rickshaw rides! But why? And what does this mean for passengers, auto...

Supreme Court Stresses Need for Safeguards Against Arrest Under GST...

The Supreme Court has upheld the constitutional validity of GST Arrest Provisions and held that BNSS/CrPC Protections...

RADHIKA AGARWAL V/s UOI: Key Rights Arrested Person Under GST Must...

The Supreme Court has upheld the constitutional validity of GST Arrest Provisions and held that BNSS/CrPC Protections...

![RADHIKA AGARWAL V/s UOI: Key Rights Arrested Person Under GST Must Remember | Supreme Court [READ ORDER] RADHIKA AGARWAL V/s UOI: Key Rights Arrested Person Under GST Must Remember | Supreme Court [READ ORDER]](https://www.jurishour.in/wp-content/uploads/2025/02/Supreme-Court-2-1.jpg)

ITC Denial Due To Place Of Business: Case Compilation

The denial of Input Tax Credit (ITC) due to the non-registration of an additional place of business or non-conducting of...

Anticipatory Bail Without FIR Permissible Under GST & Customs Act:...

In a landmark verdict, the Supreme Court has ruled that individuals facing potential arrest under the Goods and Services...

Arrest Under GST: Supreme Court Acknowledges Allegations Of Coercion...

The Supreme Court on Thursday observed that there is some merit in allegations that tax officials have been coercing...

BNSS/CrPC Protections for Arrested Persons Apply to GST & Customs...

The Supreme Court has upheld the constitutional validity of GST Arrest Provisions and held that BNSS/CrPC Protections...

Two Arrested In Rs 7.1 Crore Fraudulent ITC Claim

The Anti-Evasion Wing of the Central Goods and Services Tax (CGST) department arrested two individuals on Wednesday in...

Rs. 2,400 Crore GST Demand Confirmed Against HDFC Life Insurance |...

The Indian insurance industry is gearing up for a prolonged legal battle with tax authorities after the Goods and...

Legality Of Provisional Bank Attachment Under GST, How To Draft Reply...

The Goods and Services Tax (GST) regime in India empowers tax authorities to provisionally attach a taxpayer's property,...

Sample Request Letter To Unfreeze Bank Account To GST Department

Here’s the request letter to unfreeze bank account to GST department: [Your Name][Your Business Name][Your...

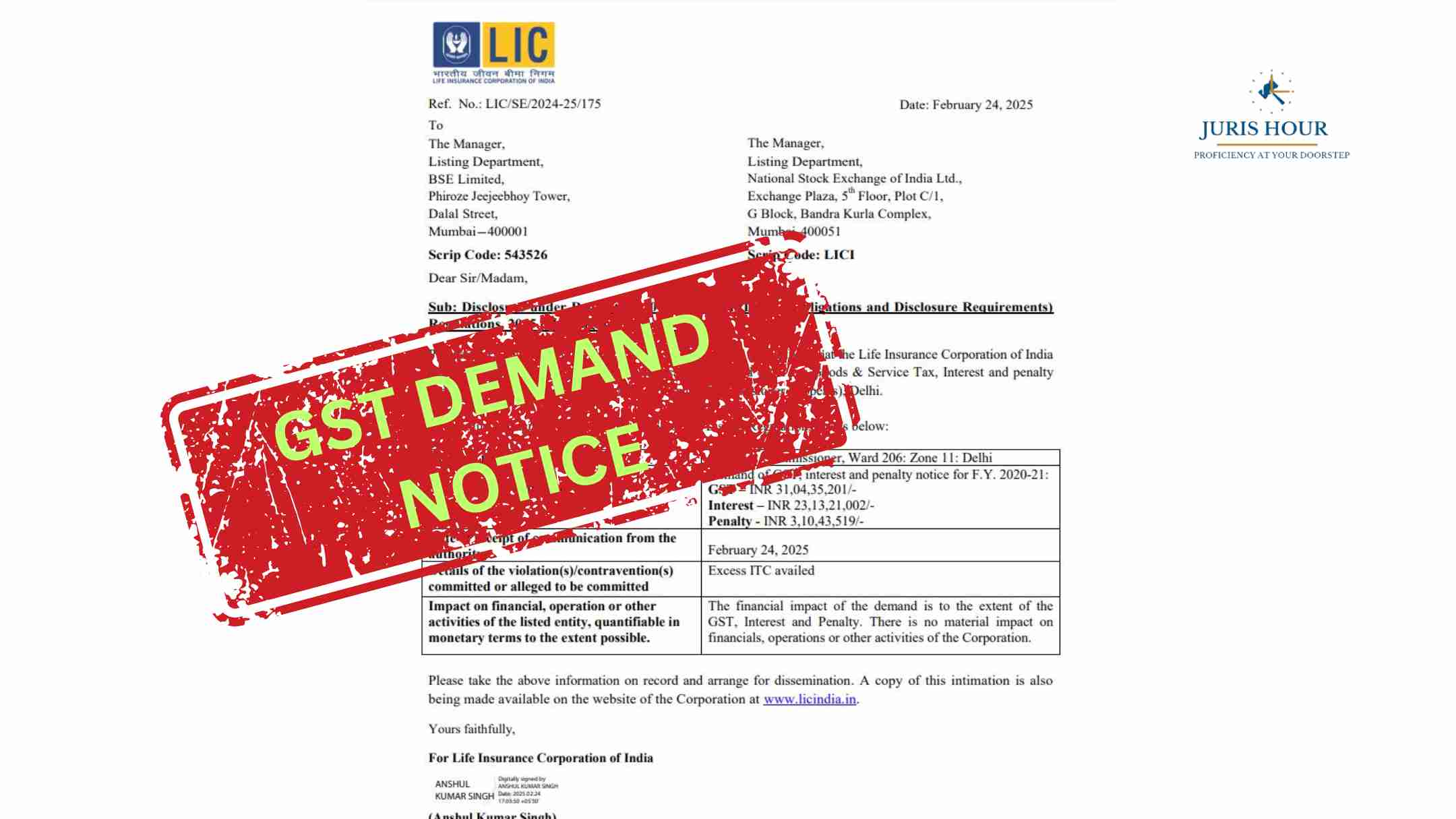

LIC Hit with Rs. 57 Crore GST Demand Notice by Tax Dept.

In a significant financial development, the Life Insurance Corporation of India (LIC) has received a GST demand notice...