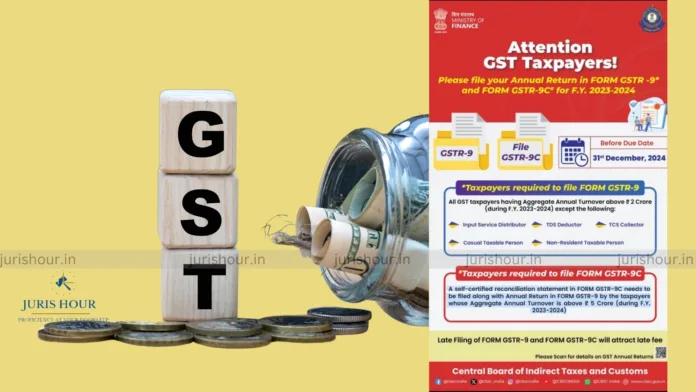

The due date for filing the annual return in FORM GSTR -9 and FORM GSTR-9C for F.Y. 2023-2024 is 31st December and late filing of FORM GSTR-9 and FORM GSTR-9C will attract late fee.

What is FORM GSTR-9?

Form GSTR -9 is an annual return to be filed once, for each financial year, by the registered taxpayers who were regular taxpayers, including SEZ units and SEZ developers.

What is FORM GSTR-9C ?

GSTR-9C is a form for annual GST reconciliation statement filed by applicable taxpayers. Every registered person whose aggregate turnover during a financial year exceeds Rs.5 crore rupees must file this form.

Who is liable to file FORM GSTR-9?

All GST taxpayers having Aggregate Annual Turnover above 2.2 Crore (during F.Y. 2023-2024).

Who are excluded from filing FORM GSTR-9?

All GST taxpayers having Aggregate Annual Turnover above 2.2 Crore (during F.Y. 2023-2024) except the following:

- Input Service Distributor

- TDS Deductor

- TCS Collector

- Casual Taxable Person

- Non-Resident Taxable Person

Who is liable to file FORM GSTR-9C?

A self-certified reconciliation statement in FORM GSTR-9C needs to be filed along with Annual Return in FORM GSTR-9 by the taxpayers whose Aggregate Annual Turnover is above & 5 Crore (during F.Y. 2023-2024)