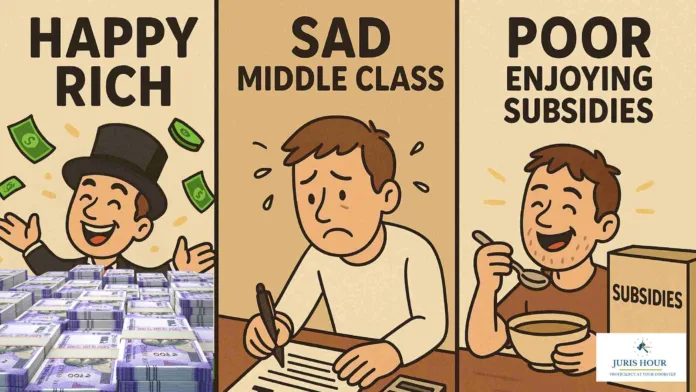

India’s tax system has been the subject of increasing scrutiny due to rising income and wealth inequality. Recent reports and economic analyses highlight that the current structure imposes disproportionate tax burdens across income groups, with the middle class contributing significantly more relative to their income than both the poor and the wealthiest.

Wealth Concentration Among the Richest 1%

As per the World Inequality Lab, the top 1% of India’s population now holds over 22.6% of the national income and more than 40% of the country’s wealth. This level of concentration places India among the highest globally in income and wealth inequality.

Tax Incidence on the Middle Class

The Indian middle class bears a significant portion of both direct and indirect taxes. Salaried individuals contribute a substantial share of the country’s income tax collections. Additionally, the Goods and Services Tax (GST) system results in indirect tax burdens that are not adjusted for income levels.

Oxfam India reports that:

- The bottom 50% of the population contributes approximately 64% of total GST collected.

- The top 10% contributes around 3%.

- The remaining middle 40% pays a considerable portion of both income tax and GST.

Impact on Low-Income Groups

Though exempt from income tax due to lower earnings, low-income individuals are subject to GST on essential goods and services. The effective tax-to-income ratio remains high in this demographic, limiting disposable income and consumption capacity.

Tax Policy Benefits for Corporates and High-Net-Worth Individuals

- The abolition of the wealth tax in 2015 reduced the taxation of high-net-worth individuals.

- In 2019, the corporate tax rate was reduced from 30% to 22% for existing companies and to 15% for new manufacturing firms.

- These reforms led to a revenue loss of ₹1.03 lakh crore in FY 2020–21, a figure comparable to India’s annual MGNREGA budget.

Recommendations from Economists

A study co-authored by economist Thomas Piketty proposes:

- A 2% annual tax on net wealth above ₹10 crore.

- A 33% inheritance tax on estates exceeding the same threshold.

According to the study, such measures could generate revenues equal to 2.73% of India’s GDP, enabling increased public investment.

Public Opinion and Government Position

Survey data from the Fight Inequality Alliance India (2021) indicates that over 80% of respondents favor taxing the wealthy and corporations that posted high profits during the pandemic. However, Prime Minister Narendra Modi recently dismissed proposals for inheritance tax, calling such ideas counterproductive.

Conclusion: Structural Imbalance in Tax Burden

India’s current taxation framework results in a structurally uneven burden:

- High-income groups receive greater fiscal benefits and reduced effective tax rates.

- The middle class contributes significantly to both direct and indirect tax revenue.

- Lower-income groups face high effective indirect tax rates relative to income, with limited compensatory benefits.

Policy discussions on progressive taxation, such as wealth and inheritance taxes, remain ongoing. Addressing this imbalance could support long-term goals related to equity, fiscal sustainability, and inclusive economic development.

Read More: No GST On Transfer Of Land Development Rights/FSI: Bombay High Court