Reassessment Notice Issued With The Approval Of JCIT Is Invalid: Delhi High Court

The Delhi High Court has quashed the reassessment notice issued with the approval of Joint Commissioner of Income Tax...

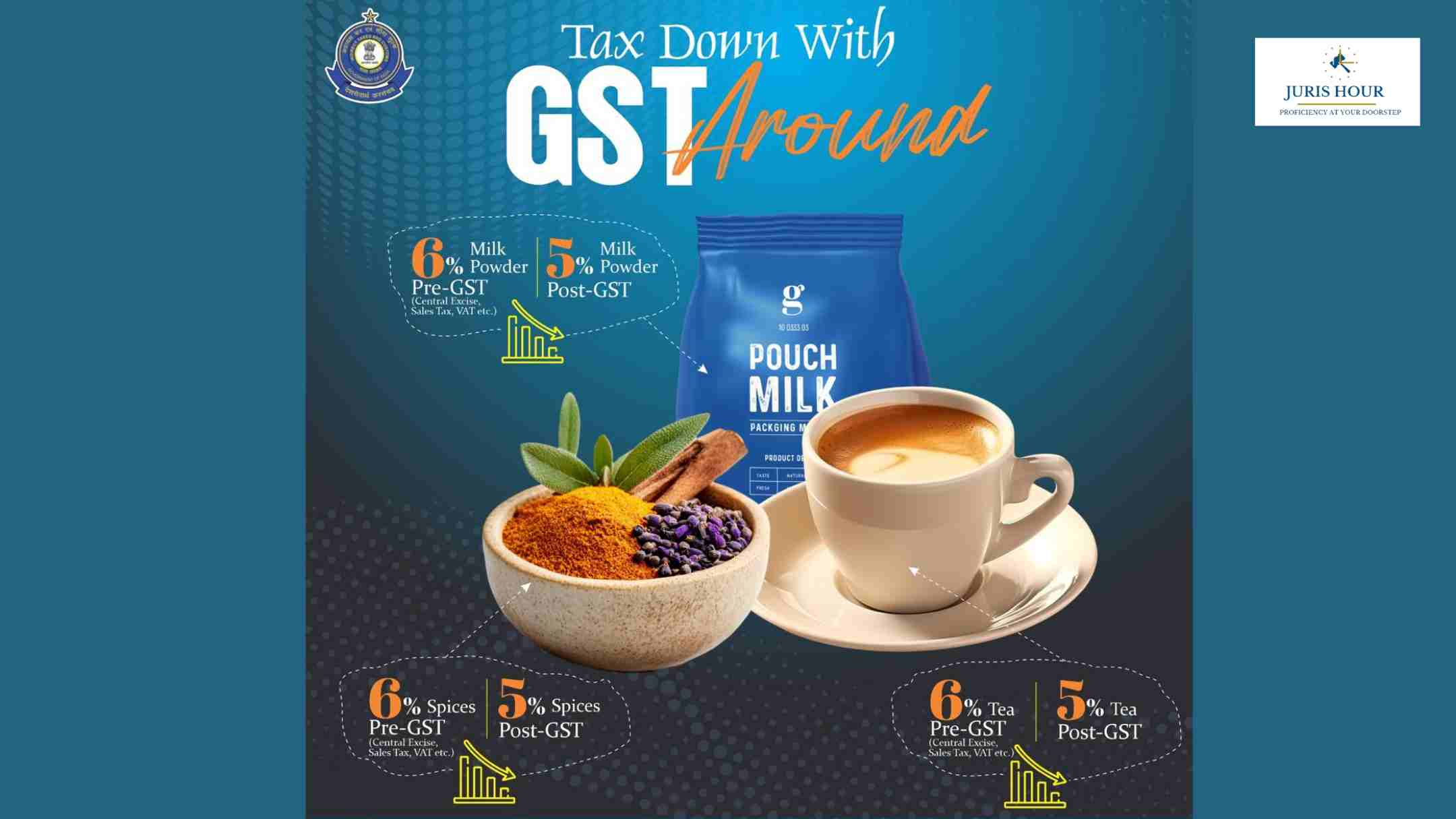

GST Relief On Milk Powder, Spices, and Tea

Consumers are benefiting from reduced tax rates on everyday essentials such as milk powder, spices, and tea, thanks to...

Delhi High Court Upholds CBEC Guidelines, Dismisses Plea Challenging Reward Criteria for Anti-Smuggling Informers

The Delhi High Court has dismissed writ petition challenging clause for determination of rewards for informers under the...

India Tightens GST Scrutiny on Foreign Digital Service Providers: DGGI Targets Non-Compliant Platforms

As India’s digital economy surges, the Goods and Services Tax (GST) authorities are stepping up enforcement against...

Patna High Court Admonishes GST Asst. Commissioner For Tampering With Records, Warns of Strict Disciplinary Action in Future

The Patna High Court has admonished the GST Assistant Commissioner, Ms. Kumari Anu Soni for tampering with records, and...

CBIC Directs PSUs on Delay in Providing Records to C&AG Auditor

The Central Board of Indirect Taxes and Customs (CBIC) has directed Public sector Undertakings (PSUs) and other entities...

Justice Yashwant Varma In-House Committee Submits Report: What Are CJI Sanjiv Khanna’s Options Now?

The Supreme Court’s in-house committee probing the serious allegations against Justice Yashwant Varma, then a sitting...

Good News For Rs. 50 Lakh to Rs. 1 Crore Income-Earners

The Central Board of Direct Taxes (CBDT) has officially notified the Income Tax Return Form-2 (ITR-2) for the financial...

Supreme Court Criticizes ED's "Pattern" of Unsupported Allegations in Chhattisgarh Liquor Scam Case

In a sharp rebuke to the Enforcement Directorate (ED), the Supreme Court observed a consistent pattern in the agency's...

GST Payable At The Time Of Issuance Of Invoice Or Receipt Of Payments Of Annuity, Whichever Is Earlier: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that GST is payable at the time of issuance of invoice or receipt of payments of...

Himachal Pradesh High Court Dismisses Retired IAS Officer Pea Challenging Notification Relaxing Eligibility For GSTAT Technical Member Appointment

The Himachal Pradesh High Court has Dismissefdthe Retired IAS Officer, Amit Kashyap’s peition challenging notification...

Allegation Of Non-Verification Of Physical Premises Of Importer Not Sufficient To Fasten Customs Broker With Penalty: CESTAT

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that allegation of...