Holding Subsidiary Company’s Shares Cannot Be Treated As ‘Supply’, No GST Payable: Karnataka High Court

The Karnataka High Court has held that the activity of holding of shares of subsidiary companies by the holding company...

Failure To Disclose Closure Of Business To Income Tax Dept. Amounts To Deliberate Malicious Act Of Concealment: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has held that the failure to disclose closure of business to...

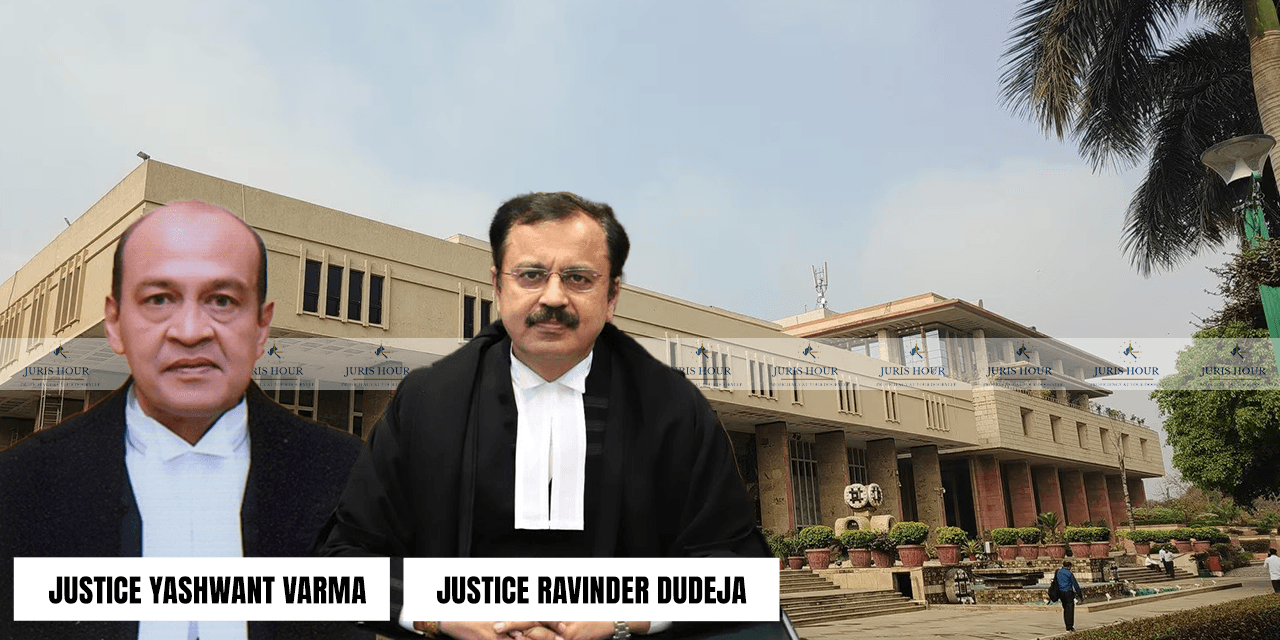

Income Tax Assessment Orders Issued Without Draft Assessment Orders: Delhi High Court Quashes Orders Against Microsoft, Sumitomo, AT Kearney India

The Delhi High Court has quashed the income tax assessment orders issued against MNCs including Microsoft, Sumitomo and...

DTVSV Act Intents Closure Of All Tax Disputes: Delhi High Court Quashes SCN & Demand Orders

The Delhi High Court while quasing the show cause notice and the income tax demand order held that the legislative...

Kerala High Court Directs Gram Panchayat To Consider Objections Against Levying Property Tax On Residential Building Equal To Commercial Buildings Rates

The Kerala High Court has directed the Gram Panchayat to consider objections against levying property tax on residential...

Not Recording Production Of Finished Goods Found Short During Physical Verification Amounts To Central Excise Rules, 2002 Violation: CESTAT

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that the appellant-manufacturer...

Direct Tax Quick Weekly Flashback: 25 To 31 August 2024

Delhi High Court AO Can Ascertain Fair Market Value Of Shares If Doubts Valuation: Delhi High Court Case name: ...

No Evidence Of Flow Back Of Money To Buyer In UAE; CESTAT Accepts Shipping Bill Value

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) while accepting the value of the shipping...

CESTAT WEEKLY FLASHBACK: 25 TO 31 AUGUST 2024

Direct Marketing Associates Providing Loan Arrangement Services To Bank Liable To Pay Service Tax On Gross Commission:...

US Tax Court Remands Back Collection Case To Consider Ability To Pay

The US Tax Court remanded the case for Appeals to reconsider petitioners’ ability to pay, and to afford petitioners a...

Appeal Filed Against Supplier’s GST Registration Cancellation; Bombay Court Grants Anticipatory Bail

The Bombay Sessions Court has granted the anticipatory bail on the ground that the cancellation of Goods and Service Tax...

Monetary Value Involved In Appeals Less Than Rs. 1 Crore: Karnataka High Court Dismisses Income Tax Dept’s Appeals

The Karnataka High Court has dismissed the income tax appeal filed by the department as the monetary value involved in...